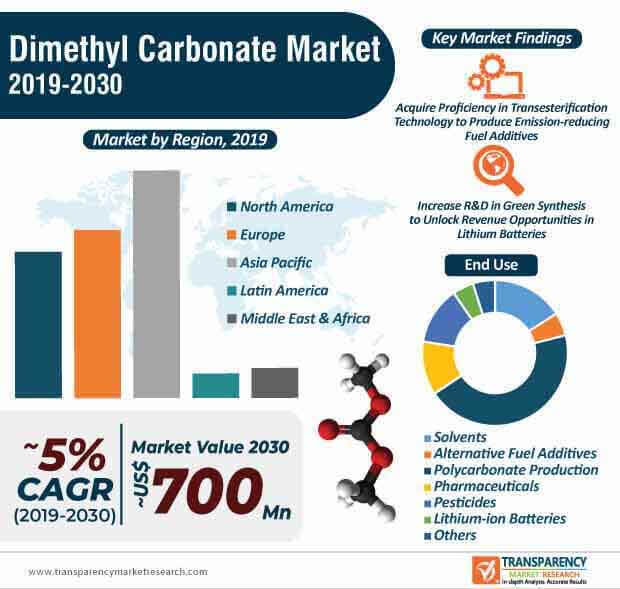

The global dimethyl carbonate market is anticipated to reach US$ 729.3 million by 2030, expanding at a CAGR of 5.4% from 2020 to 2030 (forecast period). Dimethyl carbonate (DMC) is a colorless liquid utilized as an organic solvent. DMC allows the manufacturing of polycarbonates which are transparent and strong plastics with high heat resistance. It can also be utilized in the production of pesticides in agriculture. Dimethyl carbonate has a low water solubility (0.002 percent), which increases its potential applications in the pharmaceutical, paints and coatings, and detergent industries.

The dimethyl carbonate market growth is being pushed by rising demand from a variety of industries. Furthermore, the green synthesis of dimethyl carbonate from carbon dioxide is expected to fuel market expansion.

To gauge the scope of customization in our reports Ask for a Sample

Polycarbonate is extensively utilized in a wide range of industries, including electronics, automotive, consumer goods, building and construction, and many more. Rising demand in the electronics and automotive industry is expected to propel the dimethyl carbonate market due to properties such as transparency, strength, heat resistance, and chemical resistance. Furthermore, dimethyl carbonate market growth has been fueled by expansion in the automobile sector in countries such as India, China, and Japan. Moreover, the rising need for low-cost and cost-effective consumer goods, including laptops, smartphones, smart speakers, smart home devices, power banks, and others, propels the dimethyl carbonate market forward.

Get an idea about the offerings of our report from Report Brochure

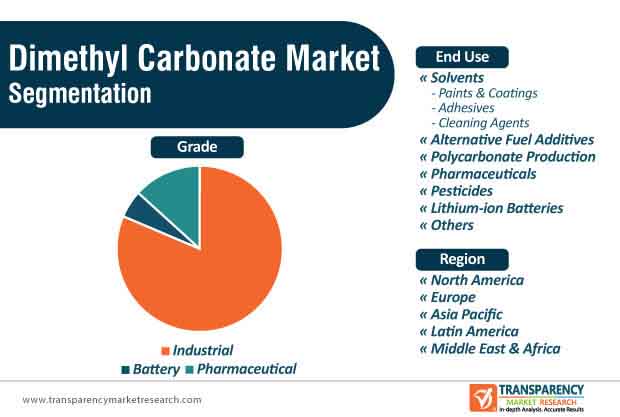

Based on grade, the dimethyl carbonate market is segmented into industrial, pharmaceutical, and battery. In 2019, the industrial grade dominated the worldwide dimethyl carbonate market with more than 80% market share. It is expected to maintain its dominance in the global dimethyl carbonate market between 2020 and 2030. Dimethyl carbonate is widely used in the production of solvents including cleaning agents, adhesives, paints and coatings, and substitute fuel additives. Furthermore, due to the expansion of the global automotive sector, the battery segment is expected to have profitable prospects during the projection period.

Looking for Regional Analysis or Competitive Landscape in Dimethyl Carbonate Market, ask for a customized report

Carbon is an abundant element essential in the production of fuels and polymers. Due to carbon's non-toxic properties, players in the dimethyl carbonate market have been pushed to convert carbon dioxide (CO2) into useful chemicals such as dimethyl carbonate (DMC). This trend is expected to continue, as conventional techniques like phosgenation have downsides, such as utilizing highly poisonous and corrosive phosgene gas and creating significant quantities of inorganic salts. As a result, players in the dimethyl carbonate market are raising their R&D efforts in order to increase efficacy in green chemistry. To improve the efficiency of green chemistry, manufacturers are employing processes that entail the direct synthesis of dimethyl carbonate from CO2 and methanol. As methanol is a less costly raw material, green synthesis of DMC is becoming more popular as a cost-effective process.

In 2019, Asia Pacific accounted for a sizable portion of the worldwide dimethyl carbonate market. Due to the substantial growth in the use of polycarbonates in the Asia Pacific, demand for dimethyl carbonate in the region is expected to rise throughout the projected period. The dimethyl carbonate market in Asia Pacific is expected to develop at a promising rate during the forecast period, owing to an increase in demand for dimethyl carbonate in various end-use applications such as cleaning agents, paints and coatings, pesticides, adhesives, and lithium-ion batteries in the region.

India, China, South Korea, and Japan are the main contributors to the region's dimethyl carbonate market. Dimethyl carbonate is primarily used in the production of polycarbonates in China, Thailand, Japan, and Taiwan, whereas it is primarily used by the pharmaceutical, paints & coatings, and agrochemical industries in India to manufacture various products such as medicines, paints, and pesticides.

Key players operating in the global dimethyl carbonate market are KOWA American Corporation, UBE Industries, Qingdao Aspirit Chemical Co., Ltd., Shandong Shida Shenghua Chemical Co., Ltd., Tokyo Chemical Industry Co., Ltd., Shandong Haike Chemical Group Co., Ltd., and Kindun Chemical Co., Limited.

Dimethyl Carbonate Market – Segmentation

This report on the global dimethyl carbonate market provides information based on grade, end use, and region.

|

Grade |

Industrial Battery Pharmaceutical |

|

End Use |

Solvents Paints & Coatings Adhesives Cleaning Agents & Others Alternative Fuel Additives Polycarbonate Production Pharmaceuticals Pesticides Lithium-ion Batteries Others |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Dimethyl Carbonate Market is expected to reach US$ 729.3 Mn By 2030

Dimethyl Carbonate Market is estimated to rise at a CAGR of 5.4% during forecast period

Rising demand in the electronics and automotive industry is expected to drive the Dimethyl Carbonate Market

Asia Pacific is more attractive for vendors in the Dimethyl Carbonate Market

Key players of Dimethyl Carbonate Market are KOWA American Corporation, UBE Industries, Qingdao Aspirit Chemical Co., Ltd., Shandong Shida Shenghua Chemical Co., Ltd., Tokyo Chemical Industry Co., Ltd., Shandong Haike Chemical Group Co., Ltd., and Kindun Chemical Co., Limited

1. Executive Summary: Global Dimethyl Carbonate Market

1.1. Global Dimethyl Carbonate Market Volume (Kilo Tons) Forecast, 2019–2030

1.2. Global Dimethyl Carbonate Market Value (US$ Mn) Forecast, by Region, 2019–2030

1.3. Trends Impacting Market

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Dimethyl Carbonate: Grade Definitions

2.2. Dimethyl Carbonate: End-use Definitions

2.3. Market Indicator

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Key Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Regulations

2.7. Value Chain Analysis

2.7.1. List of Manufacturers

2.7.2. List of Potential Customers

2.8. Dimethyl Carbonate Production Processes

3. Impact of COVID-19 on Global Dimethyl Carbonate Market

4. Production Output Analysis, 2019

5. Pricing Analysis

5.1. Pricing Analysis, by Grade

5.2. Pricing Analysis, by Country and Sub-region

6. Global Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

6.1. Global Dimethyl Carbonate Market Analysis, by Grade, 2019–2030

6.1.1. Key Findings

6.2. Global Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

6.2.1. Industrial

6.2.2. Battery

6.2.3. Pharmaceutical

6.3. Global Dimethyl Carbonate Market Analysis, by End-use, 2019–2030

6.3.1. Key Findings

6.4. Global Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

6.4.1. Solvents

6.4.1.1. Paints & Coatings

6.4.1.2. Adhesives

6.4.1.3. Cleaning Agents

6.4.2. Alternative Fuel Additives

6.4.3. Polycarbonate Production

6.4.4. Pharmaceuticals

6.4.5. Pesticides

6.4.6. Lithium-ion Batteries

6.4.7. Others

7. Global Dimethyl Carbonate Market Analysis, by Region, 2019–2030

7.1. Key Findings

7.2. Global Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2019–2030

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East & Africa

7.3. Global Dimethyl Carbonate Market Attractiveness Analysis, by Region

8. North America Dimethyl Carbonate Market Analysis

8.1. Key Findings

8.2. North America Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

8.2.1. Industrial

8.2.2. Battery

8.2.3. Pharmaceutical

8.3. North America Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

8.3.1. Solvents

8.3.1.1. Paints & Coatings

8.3.1.2. Adhesives

8.3.1.3. Cleaning Agents

8.3.2. Alternative Fuel Additives

8.3.3. Polycarbonate Production

8.3.4. Pharmaceuticals

8.3.5. Pesticides

8.3.6. Lithium-ion Batteries

8.3.7. Others

8.4. North America Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2019–2030

8.5. U.S. Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

8.5.1. Industrial

8.5.2. Battery

8.5.3. Pharmaceutical

8.6. U.S. Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

8.6.1. Solvents

8.6.1.1. Paints & Coatings

8.6.1.2. Adhesives

8.6.1.3. Cleaning Agents

8.6.2. Alternative Fuel Additives

8.6.3. Polycarbonate Production

8.6.4. Pharmaceuticals

8.6.5. Pesticides

8.6.6. Lithium-ion Batteries

8.6.7. Others

8.7. Canada Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

8.7.1. Industrial

8.7.2. Battery

8.7.3. Pharmaceutical

8.8. Canada Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

8.8.1. Solvents

8.8.1.1. Paints & Coatings

8.8.1.2. Adhesives

8.8.1.3. Cleaning Agents

8.8.2. Alternative Fuel Additives

8.8.3. Polycarbonate Production

8.8.4. Pharmaceuticals

8.8.5. Pesticides

8.8.6. Lithium-ion Batteries

8.8.7. Others

9. Europe Dimethyl Carbonate Market Analysis

9.1. Key Findings

9.2. Europe Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

9.2.1. Industrial

9.2.2. Battery

9.2.3. Pharmaceutical

9.3. Europe Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

9.3.1. Solvents

9.3.1.1. Paints & Coatings

9.3.1.2. Adhesives

9.3.1.3. Cleaning Agents

9.3.2. Alternative Fuel Additives

9.3.3. Polycarbonate Production

9.3.4. Pharmaceuticals

9.3.5. Pesticides

9.3.6. Lithium-ion Batteries

9.3.7. Others

9.4. Europe Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

9.5. Germany Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

9.5.1. Industrial

9.5.2. Battery

9.5.3. Pharmaceutical

9.6. Germany Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

9.6.1. Solvents

9.6.1.1. Paints & Coatings

9.6.1.2. Adhesives

9.6.1.3. Cleaning Agents

9.6.2. Alternative Fuel Additives

9.6.3. Polycarbonate Production

9.6.4. Pharmaceuticals

9.6.5. Pesticides

9.6.6. Lithium-ion Batteries

9.6.7. Others

9.7. France Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

9.7.1. Industrial

9.7.2. Battery

9.7.3. Pharmaceutical

9.8. France Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

9.8.1. Solvents

9.8.1.1. Paints & Coatings

9.8.1.2. Adhesives

9.8.1.3. Cleaning Agents

9.8.2. Alternative Fuel Additives

9.8.3. Polycarbonate Production

9.8.4. Pharmaceuticals

9.8.5. Pesticides

9.8.6. Lithium-ion Batteries

9.8.7. Others

9.9. U.K. Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

9.9.1. Industrial

9.9.2. Battery

9.9.3. Pharmaceutical

9.10. U.K. Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

9.10.1. Solvents

9.10.1.1. Paints & Coatings

9.10.1.2. Adhesives

9.10.1.3. Cleaning Agents

9.10.2. Alternative Fuel Additives

9.10.3. Polycarbonate Production

9.10.4. Pharmaceuticals

9.10.5. Pesticides

9.10.6. Lithium-ion Batteries

9.10.7. Others

9.11. Italy Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

9.11.1. Industrial

9.11.2. Battery

9.11.3. Pharmaceutical

9.12. Italy Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

9.12.1. Solvents

9.12.1.1. Paints & Coatings

9.12.1.2. Adhesives

9.12.1.3. Cleaning Agents

9.12.2. Alternative Fuel Additives

9.12.3. Polycarbonate Production

9.12.4. Pharmaceuticals

9.12.5. Pesticides

9.12.6. Lithium-ion Batteries

9.12.7. Others

9.13. Spain Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

9.13.1. Industrial

9.13.2. Battery

9.13.3. Pharmaceutical

9.14. Spain Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

9.14.1. Solvents

9.14.1.1. Paints & Coatings

9.14.1.2. Adhesives

9.14.1.3. Cleaning Agents

9.14.2. Alternative Fuel Additives

9.14.3. Polycarbonate Production

9.14.4. Pharmaceuticals

9.14.5. Pesticides

9.14.6. Lithium-ion Batteries

9.14.7. Others

9.15. Russia & CIS Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

9.15.1. Industrial

9.15.2. Battery

9.15.3. Pharmaceutical

9.16. Russia & CIS Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

9.16.1. Solvents

9.16.1.1. Paints & Coatings

9.16.1.2. Adhesives

9.16.1.3. Cleaning Agents

9.16.2. Alternative Fuel Additives

9.16.3. Polycarbonate Production

9.16.4. Pharmaceuticals

9.16.5. Pesticides

9.16.6. Lithium-ion Batteries

9.16.7. Others

9.17. Rest of Europe Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

9.17.1. Industrial

9.17.2. Battery

9.17.3. Pharmaceutical

9.18. Rest of Europe Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

9.18.1. Solvents

9.18.1.1. Paints & Coatings

9.18.1.2. Adhesives

9.18.1.3. Cleaning Agents

9.18.2. Alternative Fuel Additives

9.18.3. Polycarbonate Production

9.18.4. Pharmaceuticals

9.18.5. Pesticides

9.18.6. Lithium-ion Batteries

9.18.7. Others

9.19. Europe Dimethyl Carbonate Market Attractiveness Analysis

10. Asia Pacific Dimethyl Carbonate Market Analysis

10.1. Key Findings

10.2. Asia Pacific Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

10.2.1. Industrial

10.2.2. Battery

10.2.3. Pharmaceutical

10.3. Asia Pacific Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

10.3.1. Solvents

10.3.1.1. Paints & Coatings

10.3.1.2. Adhesives

10.3.1.3. Cleaning Agents

10.3.2. Alternative Fuel Additives

10.3.3. Polycarbonate Production

10.3.4. Pharmaceuticals

10.3.5. Pesticides

10.3.6. Lithium-ion Batteries

10.3.7. Others

10.4. Asia Pacific Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

10.5. China Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

10.5.1. Industrial

10.5.2. Battery

10.5.3. Pharmaceutical

10.6. China Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

10.6.1. Solvents

10.6.1.1. Paints & Coatings

10.6.1.2. Adhesives

10.6.1.3. Cleaning Agents

10.6.2. Alternative Fuel Additives

10.6.3. Polycarbonate Production

10.6.4. Pharmaceuticals

10.6.5. Pesticides

10.6.6. Lithium-ion Batteries

10.6.7. Others

10.7. Japan Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

10.7.1. Industrial

10.7.2. Battery

10.7.3. Pharmaceutical

10.8. Japan Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

10.8.1. Solvents

10.8.1.1. Paints & Coatings

10.8.1.2. Adhesives

10.8.1.3. Cleaning Agents

10.8.2. Alternative Fuel Additives

10.8.3. Polycarbonate Production

10.8.4. Pharmaceuticals

10.8.5. Pesticides

10.8.6. Lithium-ion Batteries

10.8.7. Others

10.9. India Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

10.9.1. Industrial

10.9.2. Battery

10.9.3. Pharmaceutical

10.10. India Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

10.10.1. Solvents

10.10.1.1. Paints & Coatings

10.10.1.2. Adhesives

10.10.1.3. Cleaning Agents

10.10.2. Alternative Fuel Additives

10.10.3. Polycarbonate Production

10.10.4. Pharmaceuticals

10.10.5. Pesticides

10.10.6. Lithium-ion Batteries

10.10.7. Others

10.11. ASEAN Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

10.11.1. Industrial

10.11.2. Battery

10.11.3. Pharmaceutical

10.12. ASEAN Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

10.12.1. Solvents

10.12.1.1. Paints & Coatings

10.12.1.2. Adhesives

10.12.1.3. Cleaning Agents

10.12.2. Alternative Fuel Additives

10.12.3. Polycarbonate Production

10.12.4. Pharmaceuticals

10.12.5. Pesticides

10.12.6. Lithium-ion Batteries

10.12.7. Others

10.13. Rest of Asia Pacific Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

10.13.1. Industrial

10.13.2. Battery

10.13.3. Pharmaceutical

10.14. Rest of Asia Pacific Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

10.14.1. Solvents

10.14.1.1. Paints & Coatings

10.14.1.2. Adhesives

10.14.1.3. Cleaning Agents

10.14.2. Alternative Fuel Additives

10.14.3. Polycarbonate Production

10.14.4. Pharmaceuticals

10.14.5. Pesticides

10.14.6. Lithium-ion Batteries

10.14.7. Others

10.15. Asia Pacific Dimethyl Carbonate Market Attractiveness Analysis

11. Latin America Dimethyl Carbonate Market Analysis

11.1. Key Findings

11.2. Latin America Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

11.2.1. Industrial

11.2.2. Battery

11.2.3. Pharmaceutical

11.3. Latin America Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

11.3.1. Solvents

11.3.1.1. Paints & Coatings

11.3.1.2. Adhesives

11.3.1.3. Cleaning Agents

11.3.2. Alternative Fuel Additives

11.3.3. Polycarbonate Production

11.3.4. Pharmaceuticals

11.3.5. Pesticides

11.3.6. Lithium-ion Batteries

11.3.7. Others

11.4. Latin America Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

11.5. Brazil Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

11.5.1. Industrial

11.5.2. Battery

11.5.3. Pharmaceutical

11.6. Brazil Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

11.6.1. Solvents

11.6.1.1. Paints & Coatings

11.6.1.2. Adhesives

11.6.1.3. Cleaning Agents

11.6.2. Alternative Fuel Additives

11.6.3. Polycarbonate Production

11.6.4. Pharmaceuticals

11.6.5. Pesticides

11.6.6. Lithium-ion Batteries

11.6.7. Others

11.7. Mexico Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

11.7.1. Industrial

11.7.2. Battery

11.7.3. Pharmaceutical

11.8. Mexico Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

11.8.1. Solvents

11.8.1.1. Paints & Coatings

11.8.1.2. Adhesives

11.8.1.3. Cleaning Agents

11.8.2. Alternative Fuel Additives

11.8.3. Polycarbonate Production

11.8.4. Pharmaceuticals

11.8.5. Pesticides

11.8.6. Lithium-ion Batteries

11.8.7. Others

11.9. Rest of Latin America Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

11.9.1. Industrial

11.9.2. Battery

11.9.3. Pharmaceutical

11.10. Rest of Latin America Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

11.10.1. Solvents

11.10.1.1. Paints & Coatings

11.10.1.2. Adhesives

11.10.1.3. Cleaning Agents

11.10.2. Alternative Fuel Additives

11.10.3. Polycarbonate Production

11.10.4. Pharmaceuticals

11.10.5. Pesticides

11.10.6. Lithium-ion Batteries

11.10.7. Others

11.11. Latin America Dimethyl Carbonate Market Attractiveness Analysis

12. Middle East & Africa Dimethyl Carbonate Market Analysis

12.1. Key Findings

12.2. Middle East & Africa Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

12.2.1. Industrial

12.2.2. Battery

12.2.3. Pharmaceutical

12.3. Middle East & Africa Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

12.3.1. Solvents

12.3.1.1. Paints & Coatings

12.3.1.2. Adhesives

12.3.1.3. Cleaning Agents

12.3.2. Alternative Fuel Additives

12.3.3. Polycarbonate Production

12.3.4. Pharmaceuticals

12.3.5. Pesticides

12.3.6. Lithium-ion Batteries

12.3.7. Others

12.4. Middle East & Africa Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

12.5. GCC Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

12.5.1. Industrial

12.5.2. Battery

12.5.3. Pharmaceutical

12.6. GCC Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

12.6.1. Solvents

12.6.1.1. Paints & Coatings

12.6.1.2. Adhesives

12.6.1.3. Cleaning Agents

12.6.2. Alternative Fuel Additives

12.6.3. Polycarbonate Production

12.6.4. Pharmaceuticals

12.6.5. Pesticides

12.6.6. Lithium-ion Batteries

12.6.7. Others

12.7. South Africa Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

12.7.1. Industrial

12.7.2. Battery

12.7.3. Pharmaceutical

12.8. South Africa Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

12.8.1. Solvents

12.8.1.1. Paints & Coatings

12.8.1.2. Adhesives

12.8.1.3. Cleaning Agents

12.8.2. Alternative Fuel Additives

12.8.3. Polycarbonate Production

12.8.4. Pharmaceuticals

12.8.5. Pesticides

12.8.6. Lithium-ion Batteries

12.8.7. Others

12.9. Rest of Middle East & Africa Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

12.9.1. Industrial

12.9.2. Battery

12.9.3. Pharmaceutical

12.10. Rest of Middle East & Africa Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

12.10.1. Solvents

12.10.1.1. Paints & Coatings

12.10.1.2. Adhesives

12.10.1.3. Cleaning Agents

12.10.2. Alternative Fuel Additives

12.10.3. Polycarbonate Production

12.10.4. Pharmaceuticals

12.10.5. Pesticides

12.10.6. Lithium-ion Batteries

12.10.7. Others

12.11. Middle East & Africa Dimethyl Carbonate Market Attractiveness Analysis

13. Competition Landscape

13.1. Global Dimethyl Carbonate Market Share Analysis, by Company, 2019

13.2. Competition Matrix

13.3. Application Mapping

13.4. Company Profiles

13.4.1. UBE Industries

13.4.1.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

13.4.1.2. Business Overview

13.4.1.3. Products/Services, Key End-use Industries

13.4.1.4. Financial Overview

13.4.2. Shandong Haike Chemical Group Co., Ltd.

13.4.2.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

13.4.2.2. Business Overview

13.4.2.3. Products/Services, Key End-use Industries

13.4.3. KOWA American Corporation

13.4.3.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

13.4.3.2. Business Overview

13.4.3.3. Products/Services, Key End-use Industries

13.4.4. Qingdao Aspirit Chemical Co., Ltd.

13.4.4.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

13.4.4.2. Business Overview

13.4.4.3. Products/Services, Key End-use Industries

13.4.5. Shandong Shida Shenghua Chemical Co., Ltd.

13.4.5.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

13.4.5.2. Business Overview

13.4.5.3. Products/Services, Key End-use Industries

13.4.6. Tokyo Chemical Industry Co., Ltd.

13.4.6.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

13.4.6.2. Business Overview

13.4.6.3. Products/Services, Key End-use Industries

13.4.6.4. Financial Overview

13.4.7. Shandong Depu Chemical Industry Science & Technology Co., Ltd.

13.4.7.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

13.4.7.2. Business Overview

13.4.7.3. Products/Services, Key End-use Industries

13.4.8. Dongying City Longxing Chemical Co., Ltd.

13.4.8.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

13.4.8.2. Business Overview

13.4.8.3. Products/Services, Key End-use Industries

13.4.9. Shandong Feiyang Chemical Co., Ltd.

13.4.9.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

13.4.9.2. Business Overview

13.4.9.3. Products/Services, Key End-use Industries

13.4.10. Kinden Chemical Co., Limited

13.4.10.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

13.4.10.2. Business Overview

13.4.10.3. Products/Services, Key End-use Industries

13.4.11. Alfa Aesar

13.4.11.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

13.4.11.2. Business Overview

13.4.11.3. Products/Services, Key End-use Industries

13.4.11.4. Financial Overview

13.4.11.5. Key Developments

13.4.12. Shandong Wells Chemicals Co. Ltd.

13.4.12.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

13.4.12.2. Business Overview

13.4.12.3. Products/Services, Key End-use Industries

13.4.13. Dongying Hi-tech Spring Chemical Industry Co., Ltd.

13.4.13.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

13.4.13.2. Business Overview

13.4.13.3. Products/Services, Key End-use Industries

13.4.14. Hefei TNJ Chemical Industry Co., Ltd.

13.4.14.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

13.4.14.2. Business Overview

13.4.14.3. Products/Services, Key End-use Industries

13.4.15. Hebei New Chaoyang Chemical Stock Co., Ltd.

13.4.15.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

13.4.15.2. Business Overview

13.4.15.3. Products/Services, Key End-use Industries

14. Primary Research: Key Insights

15. Appendix

15.1. Research Methodology and Assumptions

List of Tables

Table 01: Global Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

Table 02: Global Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 03: Global Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2019–2030

Table 04: North America Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

Table 05: North America Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 06: North America Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2019–2030

Table 07: U.S. Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019?2030

Table 08: U.S. Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 09: Canada Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019?2030

Table 10: Canada Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 11: Europe Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019?2030

Table 12: Europe Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 13: Europe Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 14: Germany Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

Table 15: Germany Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 16: France Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

Table 17: France Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 18: U.K. Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

Table 19: U.K. Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 20: Italy Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

Table 21: Italy Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 22: Spain Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

Table 23: Spain Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 24: Russia & CIS Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

Table 25: Russia & CIS Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 26: Rest of Europe Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

Table 27: Rest of Europe Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 28: Asia Pacific Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

Table 29: Asia Pacific Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 30: Asia Pacific Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 31: China Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

Table 32: China Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 33: Japan Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

Table 34: Japan Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 35: India Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

Table 36: India Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 37: ASEAN Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

Table 38: ASEAN Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 39: Rest of Asia Pacific Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019–2030

Table 40: Rest of Asia Pacific Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 41: Latin America Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019?2030

Table 42: Latin America Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019?2030

Table 43: Latin America Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 44: Brazil Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019?2030

Table 45: Brazil Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019?2030

Table 46: Mexico Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019?2030

Table 47: Mexico Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019?2030

Table 48: Rest of Latin America Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019?2030

Table 49: Rest of Latin America Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019?2030

Table 50: Middle East & Africa Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019?2030

Table 51: Middle East & Africa Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 52: Middle East & Africa Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 53: GCC Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019?2030

Table 54: GCC Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 55: South Africa Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019?2030

Table 56: South Africa Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

Table 57: Rest of Middle East & Africa Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2019?2030

Table 58: Rest of Middle East & Africa Dimethyl Carbonate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2019–2030

List of Figures

Figure 01: Global Dimethyl Carbonate Market Volume Share Analysis, by Grade, 2019, 2025, and 2030

Figure 02: Global Dimethyl Carbonate Market Attractiveness Analysis, by Grade, 2020–2030

Figure 03: Global Dimethyl Carbonate Market Volume Share Analysis, by End-use, 2019, 2025, and 2030

Figure 04: Global Dimethyl Carbonate Market Attractiveness Analysis, by End-use, 2020–2030

Figure 05: Global Dimethyl Carbonate Market Volume Share Analysis, by Region, 2019, 2025, and 2030

Figure 06: Global Dimethyl Carbonate Market Attractiveness Analysis, by Region, 2020–2030

Figure 07: North America Dimethyl Carbonate Market Volume Share Analysis, by Grade, 2019, 2025, and 2030

Figure 08: North America Dimethyl Carbonate Market Attractiveness Analysis, by Grade, 2020–2030

Figure 09: North America Dimethyl Carbonate Market Volume Share Analysis, by End-use, 2019, 2025, and 2030

Figure 10: North America Dimethyl Carbonate Market Attractiveness Analysis, by End-use, 2020–2030

Figure 11: North America Dimethyl Carbonate Market Volume Share Analysis, by Country, 2019, 2025, and 2030

Figure 12: North America Dimethyl Carbonate Market Attractiveness Analysis, by Country

Figure 13: Europe Dimethyl Carbonate Market Volume Share Analysis, by Grade, 2019, 2025, and 2030

Figure 14: Europe Dimethyl Carbonate Market Attractiveness Analysis, by Grade, 2020–2030

Figure 15: Europe Dimethyl Carbonate Market Volume Share Analysis, by End-use, 2019, 2025, and 2030

Figure 16: Europe Dimethyl Carbonate Market Attractiveness Analysis, by End-use, 2020–2030

Figure 17: Europe America Dimethyl Carbonate Market Volume Share Analysis, by Country and Sub-region, 2019, 2025, and 2030

Figure 18: Europe Dimethyl Carbonate Market Attractiveness Analysis, by Country and Sub-region, 2020–2030

Figure 19: Asia Pacific Dimethyl Carbonate Market Volume Share Analysis, by Grade, 2019, 2025, and 2030

Figure 20: Asia Pacific Dimethyl Carbonate Market Attractiveness Analysis, by Grade, 2020–2030

Figure 21: Asia Pacific Dimethyl Carbonate Market Volume Share Analysis, by End-use, 2019, 2025, and 2030

Figure 22: Asia Pacific Dimethyl Carbonate Market Attractiveness Analysis, by End-use, 2020–2030

Figure 23: Asia Pacific Dimethyl Carbonate Market Volume Share Analysis, by Country and Sub-region, 2019, 2025, and 2030

Figure 24: Asia Pacific Dimethyl Carbonate Market Attractiveness Analysis, by Country and Sub-region, 2020–2030

Figure 25: Latin America Dimethyl Carbonate Market Volume Share Analysis, by Grade, 2019, 2025, and 2030

Figure 26: Latin America Dimethyl Carbonate Market Attractiveness Analysis, by Grade, 2020–2030

Figure 27: Latin America Dimethyl Carbonate Market Volume Share Analysis, by End-use, 2019, 2025, and 2030

Figure 28: Latin America Dimethyl Carbonate Market Attractiveness Analysis, by End-use, 2020–2030

Figure 29: Latin America Dimethyl Carbonate Market Volume Share Analysis, by Country and Sub-region, 2019, 2025, and 2030

Figure 30: Latin America Dimethyl Carbonate Market Attractiveness Analysis, by Country and Sub-region, 2020–2030

Figure 31: Middle East & Africa Dimethyl Carbonate Market Volume Share Analysis by Grade, 2019, 2025, and 2030

Figure 32: Middle East & Africa Dimethyl Carbonate Market Attractiveness Analysis, by Grade, 2020–2030

Figure 33: Middle East & Africa Dimethyl Carbonate Market Volume Share Analysis, by End-use, 2019, 2025, and 2030

Figure 34: Middle East & Africa Dimethyl Carbonate Market Attractiveness Analysis, by End-use, 2020–2030

Figure 35: Middle East & Africa Dimethyl Carbonate Market Volume Share Analysis, by Country and Sub-region, 2019, 2025, and 2030

Figure 36: Middle East & Africa Dimethyl Carbonate Market Attractiveness Analysis, by Country and Sub-region, 2020–2030

Figure 37: Company Market Share Analysis, 2019