Dairy Alternatives Market - Snapshot

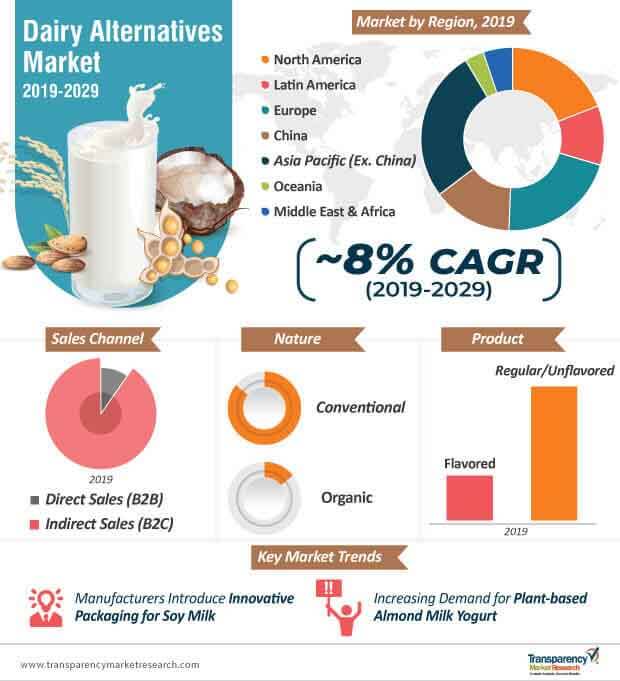

A rise in the focus of consumers on the various nutritional values such as high vitamin and protein content and low calories of milk is likely to influence the growth trajectory of the global dairy alternatives market in the near future.

Soymilk is a popular dairy alternative, which comes with multiple minerals such as magnesium, potassium, sodium, zinc, phosphorous, calcium, and iron. This dairy alternative is extremely popular amongst patients with heart issues as it diminishes levels of cholesterol. In addition to that, soymilk comes with as much protein as cow milk and is quite low in calories as compared to skim and whole milk. As such, augmented consumption of soymilk is likely to drive the demand for dairy alternatives in the years to come. It is estimated that consumption of dairy alternatives is likely to rise with the outbreak of a global pandemic, COVID-19. In a bid to boost immunity to survive COVID-19, people are expected to increase consumption of nutritious dairy alternatives. As such, it is expected that the global dairy alternatives market is likely to witness rapid growth during the times of COVID-19 and afterwards.

Expansion in the Pool of Geriatric Population to Spell Growth of the Market

Many consumers consider a vegan diet to be a highly nutritious and healthy one. Such people prefer having various dairy alternatives such as

In addition, many other plant-based milk products. Increased adoption of a vegan diet is likely to play a positive role in the expansion of the global dairy alternatives market.

Implementation of effective marketing technologies such as segmentation and diversification can lead to an increase in the sales of dairy alternatives. The main objective behind such marketing strategies is to generate demand for these products amongst various types of consumers such as vegans, trainers, and lactose intolerant consumers. Furthermore, it is essential to place the product at the right place, right time, and through the right channel of sales.

Players in the dairy alternatives market are introducing unique dairy alternatives in the food and beverage landscape. According to NIH (National Institutes of Health), ~65% of the world population faces the issue of lactose intolerance. This is why manufacturers in the dairy alternatives market are innovating on alternatives such as soy milk with chickpea protein.

To add further value to their products, dairy alternatives market manufacturers are innovating on novel packaging options such as microwaveable aseptic carton packs. In order to provide 'on-the-go' convenience for consumers, soy milk is designed to be served warm with first-of-its-kind technology of microwaveable packaging. This helps in brand enhancement and premiumization of nutritional beverages, which leads to flexibility for sales through various distribution channels.

Manufacturers in the dairy alternatives market are developing fail-safe packaging mechanisms to protect the product from light, oxygen, scent, water, and even overheating. As such, dairy alternatives market players are increasing the distribution of soy milk products using online retail channels, groceries, and convenience stores. The nutritional value of soy milk is leveraged with high protein ingredients such as cabbage, banana, broccoli, and the like.

To understand how our report can bring difference to your business strategy, Ask for a brochure

Manufacturers are increasing product line offerings with expansions in non-dairy alternatives. They are introducing plant-based offerings such as almond milk yogurt. This dairy alternative is made using premium-quality almonds and interesting add-ons such as granola and chocolate chips, to provide excellent taste and texture to the product. Plant-based almond milk yogurt serves as a high quality dairy alternative, free from allergens such as lactose.

Due to the growing demand from consumers for delicious plant-based foods, manufacturers are introducing the crunchy goodness of almonds and other toppings to bring innovation into the growing plant-based yogurt space. For instance, in May 2019, Blue Diamond Growers — a California agricultural cooperative, announced the launch of Almond Breeze Almond milk Yogurt Alternative, a dairy substitute that is a new addition to its plant-based yogurt category.

As the dairy alternatives market is estimated to grow to a value of ~US$ 34.6 billion by the year 2029, oat milk is gaining consumer attention with the introduction of innovative oat milk beverages. Companies are looking to profit from the surge in non-dairy milk sales, and are introducing oat beverages in unflavored as well as flavored essence, such as vanilla.

Request a sample to get extensive insights into the Dairy Alternatives Market

The dairy alternatives market has dominated product innovation and grown tremendously in the last couple of years, which has led to a significant threat to the sales of traditional dairy products. However, the growing demand for plant-based foods has given rise to environmental concerns. Manufacturers have to exert tremendous pressure on water resources to cultivate almonds. Also, rice emits the most greenhouse gases, such as methane, due to bacterial activity in flooded rice paddies. The cultivation of soy and oats requires large land areas, thus leading to deforestation.

Since children are one of the key consumers of dairy alternatives and plant-based milks, the nutritional content of certain plant-based milks do not suffice requirements. For example, almond milk is low in protein, rice milk contains low levels of arsenic, and hemp milk is not easily available in supermarkets and other retail stores. Thus, market players need to consider long-term environmental costs and dietary changes of consumers from dairy to plant-based diets to effectively push the sales of non-dairy products.

Stuck in a neck-to-neck competition with other brands? Request a custom report on “Dairy Alternatives Market”

Dairy Alternatives Market: Analysts’ Viewpoint

Analysts of the dairy alternatives market opine that the market will experience promising growth during the forecast period. Manufacturers must cater to the growing demand for microwaveable and nutritious plant-based beverages for on-the-go consumption, especially targeting in Asia. The concept of active nutrition is increasing in the sports nutrition space with the growing adoption of plant-based diets. Also, vegan cheese is triggering sales in the dairy alternatives market. However, market players are challenged with environmental costs and lack of product availability in developing economies. Thus, manufacturers are adopting sustainable crop cultivation techniques, and increasing distribution via online home shopping channels, specialty stores, and supermarkets. Market players should focus on innovative offerings in soy and almond milk products.

Dairy Alternatives Remain More Preferred than Dairy Products

Asia Pacific to Lead Market Growth

Growing Concerns Regarding Animal Welfare

Rising Prevalence of Dietary Restrictions

Increasing Vegan Population Driving the Market Demand for Dairy Alternatives

Dairy Alternatives Market: Key Players

Key players in the global dairy alternatives market are

Dairy Alternatives Market: Key Developments

Some of the key developments seen in the dairy alternatives market from the past few years are as follows:

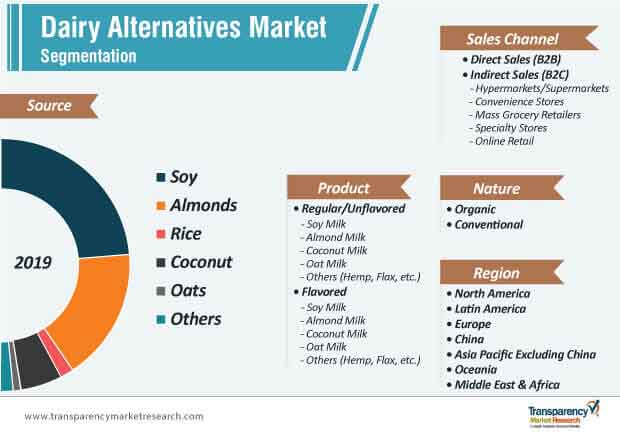

Key Segments of the Dairy Alternatives Market

TMR’s study on the dairy alternatives market offers information divided into important segments—source, product, nature, sales channel, and region. This report offers comprehensive data and information about the important market dynamics and growth parameters associated with these categories.

|

Source |

|

|

Product |

|

|

Nature |

|

|

Sales Channel |

|

|

Region |

|

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand-Side Trends

1.3. Supply-Side Trends

1.4. Technology Roadmap Analysis

1.5. Fmi Analysis And Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting The Market

3.2. Technology Trends

3.3. Product Innovation / New Launches / Patents

4. Key Success Factors

4.1. Product Lifecycle Analysis

4.2. Quality Certifications And Claims Impact Analysis

4.3. Product Branding And Promotional Strategies

5. Global Dairy Alternatives Market Demand / Consumption (Metric Tons) Analysis

5.1. Historical Market Volume (Metric Tons) Analysis

5.2. Current And Future Market Volume Projections

5.3. Y-O-Y Growth Trend Analysis

6. Global Dairy Alternatives Market Pricing Analysis

6.1. Regional Average Pricing Analysis (Us$/Mt) By Source / Extraction Method

6.2. Pricing Break-Up

6.2.1. Manufacturer Level Pricing

6.2.2. Distributor Level Pricing

6.2.3. Pricing Mark-Ups

6.2.3.1. Transportation Costs

6.2.3.2. Miscellaneous Costs

6.3. Global Average Pricing Analysis Benchmark

7. Global Dairy Alternatives Market Demand / Consumption (Size In Us$ Mn) Analysis

7.1. Historical Market Value (Us$ Mn) Analysis

7.2. Current And Future Market Value (Us$ Mn) Projections

7.2.1. Y-O-Y Growth Trend Analysis

7.2.2. Absolute $ Opportunity Analysis

8. Dairy Alternatives Market Context

8.1. Global Dairy Market Overview

8.2. Nutritional Composition Of Dairy Alternatives

8.3. List Of Functional Ingredients Used In Dairy Alternatives

8.4. Policy Developments And Regulatory Scenario

8.5. Purchase Pattern Assessment

8.6. Macro-Economic Indicators

8.6.1. Global Gdp By Region And Country, 2006–2021

8.6.2. Global Industry Value Added

8.6.3. Global Food & Beverages Industry Outlook

8.7. Value Chain Analysis

8.8. Raw Material Suppliers

8.9. Dairy Alternatives Producers

8.10. Wholesalers / Distributors

8.11. Traders

8.12. Retailers

8.13. End Use Segments

8.14. Market Dynamics

8.14.1. Drivers

8.14.2. Restraints

8.14.3. Opportunities

8.14.4. Trends

8.15. Forecast Factors – Relevance And Impact

9. Global Dairy Alternatives Market Analysis 2014–2018 And Forecast 2019–2029, By Source

9.1. Introduction

9.1.1. Market Value Share Analysis By Source

9.1.2. Y-O-Y Growth Analysis By Source

9.2. Historical Market Value (Us$ Mn) And Volume (Metric Tons) By Source, 2014–2018

9.3. Market Value (Us$ Mn) And Volume (Metric Tons) Forecast By Source, 2019-2029

9.3.1. Soy

9.3.2. Almond

9.3.3. Rice

9.3.4. Coconut

9.3.5. Oats

9.3.6. Others

9.4. Market Attractiveness Analysis By Source

10. Global Dairy Alternatives Market Analysis 2014–2018 And Forecast 2019–2029, By Product

10.1. Introduction

10.1.1. Market Value Share Analysis By Product

10.1.2. Y-O-Y Growth Analysis By Product

10.2. Historical Market Value (Us$ Mn) And Volume (Metric Tons) By Product, 2014–2018

10.3. Market Value (Us$ Mn) And Volume (Metric Tons) Forecast By Product, 2019-2029

10.3.1. Regular/Unflavoured

10.3.1.1. Soy Milk

10.3.1.2. Almond Milk

10.3.1.3. Coconut Milk

10.3.1.4. Oat Milk

10.3.1.5. Others (Hemp, Flax, Etc.)

10.3.2. Flavoured

10.3.2.1. Soy Milk

10.3.2.2. Almond Milk

10.3.2.3. Coconut Milk

10.3.2.4. Oat Milk

10.3.2.5. Others (Hemp, Flax, Etc.)

10.4. Market Attractiveness Analysis By Product

11. Global Dairy Alternatives Market Analysis 2014–2018 And Forecast 2019–2029, By Nature

11.1. Introduction

11.1.1. Market Value Share Analysis By Nature

11.1.2. Y-O-Y Growth Analysis By Nature

11.2. Historical Market Value (Us$ Mn) And Volume (Metric Tons) By Nature, 2014–2018

11.3. Market Value (Us$ Mn) And Volume (Metric Tons) Forecast By Nature, 2019-2029

11.3.1. Organic

11.3.2. Conventional

11.4. Market Attractiveness Analysis By Nature

12. Global Dairy Alternatives Market Analysis 2014–2018 And Forecast 2019–2029, By Sales Channel

12.1. Introduction

12.1.1. Market Value Share Analysis By Sales Channel

12.1.2. Y-O-Y Growth Analysis By Sales Channel

12.2. Historical Market Value (Us$ Mn) And Volume (Metric Tons) By Sales Channel, 2014–2018

12.3. Market Value (Us$ Mn) And Volume (Metric Tons) Forecast By Sales Channel, 2019-2029

12.3.1. Direct Sales/B2b

12.3.2. Indirect Sales/B2c

12.3.2.1. Hypermarkets/ Supermarkets

12.3.2.2. Convenience Stores

12.3.2.3. Specialty Stores

12.3.2.4. Wholesale Store

12.3.2.5. Online Retailing

12.4. Market Attractiveness Analysis By Sales Channel

13. Global Dairy Alternatives Market Analysis And Forecast, By Region

13.1. Introduction

13.1.1. Market Value Share Analysis By Region

13.1.2. Y-O-Y Growth Analysis By Region

13.2. Historical Market Value (Us$ Mn) And Volume (Metric Tons) By Region, 2014–2018

13.3. Market Value (Us$ Mn) And Volume (Metric Tons) Forecast By Region, 2019-2029

13.3.1. North America

13.3.2. Latin America

13.3.3. Europe

13.3.4. China

13.3.5. Asia Pacific Excluding China

13.3.6. Oceania

13.3.7. Middle East And Africa

13.4. Market Attractiveness Analysis By Region

14. North America Dairy Alternatives Market Analysis 2014–2018 And Forecast 2019–2029

14.1. Introduction

14.2. Pricing Analysis

14.3. Historical Market Value (Us$ Mn) And Volume (Metric Tons) By Market Segments, 2014–2018

14.4. Market Value (Us$ Mn) And Volume (Metric Tons) Forecast By Market Segments, 2019-2029

14.4.1. By Country

14.4.1.1. United States

14.4.1.2. Canada

14.4.2. By Source

14.4.3. By Product

14.4.4. By Nature

14.4.5. By Sales Channel

14.5. Market Attractiveness Analysis

14.5.1. By Country

14.5.2. By Source

14.5.3. By Product

14.5.4. By Nature

14.5.5. By Sales Channel

14.6. Drivers And Restraints: Impact Analysis

14.7. Key Participants Market Presence Intensity Mapping

15. Latin America Dairy Alternatives Market Analysis 2014–2018 And Forecast 2019–2029

15.1. Introduction

15.2. Pricing Analysis

15.3. Historical Market Value (Us$ Mn) And Volume (Metric Tons) By Market Segments, 2014–2018

15.4. Market Value (Us$ Mn) And Volume (Metric Tons) Forecast By Market Segments, 2019-2029

15.4.1. By Country

15.4.1.1. Brazil

15.4.1.2. Mexico

15.4.1.3. Argentina

15.4.1.4. Rest Of Latin America

15.4.2. By Source

15.4.3. By Product

15.4.4. By Nature

15.4.5. By Sales Channel

15.5. Market Attractiveness Analysis

15.5.1. By Country

15.5.2. By Source

15.5.3. By Product

15.5.4. By Nature

15.5.5. By Sales Channel

15.6. Drivers And Restraints: Impact Analysis

15.7. Key Participants Market Presence Intensity Mapping

16. Europe Dairy Alternatives Market Analysis 2014–2018 And Forecast 2019–2029

16.1. Introduction

16.2. Pricing Analysis

16.3. Historical Market Value (Us$ Mn) And Volume (Metric Tons) By Market Segments, 2014–2018

16.4. Market Value (Us$ Mn) And Volume (Metric Tons) Forecast By Market Segments, 2019-2029

16.4.1. By Country

16.4.1.1. Germany

16.4.1.2. U.K.

16.4.1.3. France

16.4.1.4. Italy

16.4.1.5. Spain

16.4.1.6. Benelux

16.4.1.7. Nordic

16.4.1.8. Russia

16.4.1.9. Poland

16.4.1.10. Rest Of Western Europe

16.4.2. By Source

16.4.3. By Product

16.4.4. By Nature

16.4.5. By Packaging

16.4.6. By Sales Channel

16.5. Market Attractiveness Analysis

16.5.1. By Country

16.5.2. By Source

16.5.3. By Product

16.5.4. By Nature

16.5.5. By Sales Channel

16.6. Drivers And Restraints: Impact Analysis

16.7. Key Participants Market Presence Intensity Mapping

17. China Dairy Alternatives Market Analysis 2014–2018 And Forecast 2019–2029

17.1. Introduction

17.2. Pricing Analysis

17.3. Historical Market Value (Us$ Mn) And Volume (Metric Tons) By Market Segments, 2014–2018

17.4. Market Value (Us$ Mn) And Volume (Metric Tons) Forecast By Market Segments, 2019-2029

17.4.1. By Source

17.4.2. By Product

17.4.3. By Nature

17.4.4. By Sales Channel

17.5. Market Attractiveness Analysis

17.5.1. By Source

17.5.2. By Product

17.5.3. By Nature

17.5.4. By Sales Channel

17.6. Drivers And Restraints: Impact Analysis

17.7. Key Participants Market Presence Intensity Mapping

18. Asia Pacific Excluding China Dairy Alternatives Market Analysis 2014–2018 And Forecast 2019–2029

18.1. Introduction

18.2. Pricing Analysis

18.3. Historical Market Value (Us$ Mn) And Volume (Metric Tons) By Market Segments, 2014–2018

18.4. Market Value (Us$ Mn) And Volume (Metric Tons) Forecast By Market Segments, 2019-2029

18.4.1. By Country

18.4.1.1. India

18.4.1.2. Japan

18.4.1.3. Asean

18.4.1.4. Rest Of Asia Pacific Excluding China

18.4.2. By Source

18.4.3. By Product

18.4.4. By Nature

18.4.5. By Sales Channel

18.5. Market Attractiveness Analysis

18.5.1. By Country

18.5.2. By Source

18.5.3. By Product

18.5.4. By Nature

18.5.5. By Sales Channel

18.6. Drivers And Restraints: Impact Analysis

18.7. Key Participants Market Presence Intensity Mapping

19. Oceania Dairy Alternatives Market Analysis 2014–2018 And Forecast 2019–2029

19.1. Introduction

19.2. Pricing Analysis

19.3. Historical Market Value (Us$ Mn) And Volume (Metric Tons) By Market Segments, 2014–2018

19.4. Market Value (Us$ Mn) And Volume (Metric Tons) Forecast By Market Segments, 2019-2029

19.4.1. By Country

19.4.1.1. Australia

19.4.1.2. New Zealand

19.4.2. By Source

19.4.3. By Product

19.4.4. By Nature

19.4.5. By Sales Channel

19.5. Market Attractiveness Analysis

19.5.1. By Country

19.5.2. By Source

19.5.3. By Product

19.5.4. By Nature

19.5.5. By Sales Channel

19.6. Drivers And Restraints: Impact Analysis

19.7. Key Participants Market Presence Intensity Mapping

20. Middle East & Africa Dairy Alternatives Market Analysis 2014–2018 And Forecast 2019–2029

20.1. Introduction

20.2. Pricing Analysis

20.3. Historical Market Value (Us$ Mn) And Volume (Metric Tons) By Market Segments, 2014–2018

20.4. Market Value (Us$ Mn) And Volume (Metric Tons) Forecast By Market Segments, 2019-2029

20.4.1. By Country

20.4.1.1. Gcc Countries

20.4.1.2. Turkey

20.4.1.3. South Africa

20.4.1.4. Rest Of Mea

20.4.2. By Source

20.4.3. By Product

20.4.4. By Nature

20.4.5. By Sales Channel

20.5. Market Attractiveness Analysis

20.5.1. By Country

20.5.2. By Source

20.5.3. By Product

20.5.4. By Nature

20.5.5. By Sales Channel

20.6. Drivers And Restraints: Impact Analysis

20.7. Key Participants Market Presence Intensity Mapping

21. Dairy Alternatives Market Structure Analysis

21.1. Market Analysis By Tier Of Companies

21.2. Market Concentration

21.3. Market Share (Top 3 Or Top 5 Players) Analysis, By Region

21.3.1. Asia Pacific

21.3.2. Europe

21.3.3. North America

21.4. Brand Share (Top 3 Or Top 5 Brands) Analysis, By Region

21.4.1. North America

21.4.2. Asia Pacific

21.4.3. Europe

21.5. Market Presence Analysis

21.5.1. By Regional Footprint

21.5.2. By Product Footprint

21.5.3. By Channel Footprint

22. Competition Analysis

22.1. Competition Dashboard

22.2. Pricing Analysis, By Competition

22.3. Competition Benchmarking

22.4. Profitability And Gross Margin Analysis By Competition

22.5. Competition Developments (Mergers, Acquisitions And Expansions)

22.6. Competition Deepdive (Tentative List)

22.6.1. The Hain Celestial Group

22.6.1.1. Overview

22.6.1.2. Product Portfolio

22.6.1.3. Production Footprint

22.6.1.4. Sales Footprint

22.6.1.5. Strategy Overview

22.6.1.5.1. Marketing Strategy

22.6.1.5.2. Product Strategy

22.6.2. Sunopta, Inc.

22.6.2.1. Overview

22.6.2.2. Product Portfolio

22.6.2.3. Production Footprint

22.6.2.4. Sales Footprint

22.6.2.5. Strategy Overview

22.6.2.5.1. Marketing Strategy

22.6.2.5.2. Product Strategy

22.6.3. Earths Own Food Company

22.6.3.1. Overview

22.6.3.2. Product Portfolio

22.6.3.3. Production Footprint

22.6.3.4. Sales Footprint

22.6.3.5. Strategy Overview

22.6.3.5.1. Marketing Strategy

22.6.3.5.2. Product Strategy

22.6.4. Freedom Foods Group

22.6.4.1. Overview

22.6.4.2. Product Portfolio

22.6.4.3. Production Footprint

22.6.4.4. Sales Footprint

22.6.4.5. Strategy Overview

22.6.4.5.1. Marketing Strategy

22.6.4.5.2. Product Strategy

22.6.5. Dohler Gmbh

22.6.5.1. Overview

22.6.5.2. Product Portfolio

22.6.5.3. Production Footprint

22.6.5.4. Sales Footprint

22.6.5.5. Strategy Overview

22.6.5.5.1. Marketing Strategy

22.6.5.5.2. Product Strategy

22.6.6. Organic Valley

22.6.6.1. Overview

22.6.6.2. Product Portfolio

22.6.6.3. Production Footprint

22.6.6.4. Sales Footprint

22.6.6.5. Strategy Overview

22.6.6.5.1. Marketing Strategy

22.6.6.5.2. Product Strategy

22.6.7. Triballat Noyal

22.6.7.1. Overview

22.6.7.2. Product Portfolio

22.6.7.3. Production Footprint

22.6.7.4. Sales Footprint

22.6.7.5. Strategy Overview

22.6.7.5.1. Marketing Strategy

22.6.7.5.2. Product Strategy

22.6.8. Blue Diamond Growers

22.6.8.1. Overview

22.6.8.2. Product Portfolio

22.6.8.3. Production Footprint

22.6.8.4. Sales Footprint

22.6.8.5. Strategy Overview

22.6.8.5.1. Marketing Strategy

22.6.8.5.2. Product Strategy

22.6.9. Daiya Foods Inc.

22.6.9.1. Overview

22.6.9.2. Product Portfolio

22.6.9.3. Production Footprint

22.6.9.4. Sales Footprint

22.6.9.5. Strategy Overview

22.6.9.5.1. Marketing Strategy

22.6.9.5.2. Product Strategy

22.6.10. Califia Farms

22.6.10.1. Overview

22.6.10.2. Product Portfolio

22.6.10.3. Production Footprint

22.6.10.4. Sales Footprint

22.6.10.5. Strategy Overview

22.6.10.5.1. Marketing Strategy

22.6.10.5.2. Product Strategy

22.6.11. Sanitarium Health And Wellbeing Company

22.6.11.1. Overview

22.6.11.2. Product Portfolio

22.6.11.3. Production Footprint

22.6.11.4. Sales Footprint

22.6.11.5. Strategy Overview

22.6.11.5.1. Marketing Strategy

22.6.11.5.2. Product Strategy

22.6.12. Nutriops S.L.

22.6.12.1. Overview

22.6.12.2. Product Portfolio

22.6.12.3. Production Footprint

22.6.12.4. Sales Footprint

22.6.12.5. Strategy Overview

22.6.12.5.1. Marketing Strategy

22.6.12.5.2. Product Strategy

23. Assumptions And Acronyms Used

List of Tables

Table 01: Global Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Source

Table 02: Global Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Source

Table 03: Global Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Product

Table 04: Global Dairy Alternatives Historical Market Volume (MT) 2014-2018 and Forecast 2019-2029 by Product

Table 05: Global Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Nature

Table 06: Global Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Nature

Table 07: Global Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Sales Channel

Table 08: Global Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Sales Channel

Table 09: Global Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Region

Table 10: Global Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Region

Table 11: North America Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Source

Table 12: North America Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Source

Table 13: North America Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Product

Table 14: North America Dairy Alternatives Historical Market Volume (MT) 2014-2018 and Forecast 2019-2029 by Product

Table 15: North America Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Nature

Table 16: North America Dairy Alternatives Historical Market Volume (MT) 2014-2018 and Forecast 2019-2029 by Nature

Table 17: North America Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Sales Channel

Table 18: North America Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Sales Channel

Table 19: North America Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Country

Table 20: North America Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Country

Table 21: Latin America Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Source

Table 22: Latin America Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Source

Table 23: Latin America Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Product

Table 24: Latin America Dairy Alternatives Historical Market Volume (MT) 2014-2018 and Forecast 2019-2029 by Product

Table 25: Latin America Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Nature

Table 26: Latin America Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Nature

Table 27: Latin America Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Sales Channel

Table 28: Latin America Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Sales Channel

Table 29: Latin America Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Country

Table 30: Latin America Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Country

Table 31: Europe Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Source

Table 32: Europe Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Source

Table 33: Europe Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Product

Table 34: Europe Dairy Alternatives Historical Market Volume (MT) 2014-2018 and Forecast 2019-2029 by Product

Table 35: Europe Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Nature

Table 36: Europe Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Nature

Table 37: Europe Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Sales Channel

Table 38: Europe Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Sales Channel

Table 39: Europe Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Country

Table 40: Europe Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Country

Table 41: China Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Source

Table 42: China Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Source

Table 43: China Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Product

Table 44: China Dairy Alternatives Historical Market Volume (MT) 2014-2018 and Forecast 2019-2029 by Product

Table 45: China Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Nature

Table 46: China Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Nature

Table 47: China Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Sales Channel

Table 48: China Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Sales Channel

Table 49: Asia Pacific Excluding China Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Source

Table 50: Asia Pacific Excluding China Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Source

Table 51: Asia Pacific Excluding China Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Product

Table 52: Asia Pacific Excluding China Dairy Alternatives Historical Market Volume (MT) 2014-2018 and Forecast 2019-2029 by Product

Table 53: Asia Pacific Excluding China Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Nature

Table 54: Asia Pacific Excluding China Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Nature

Table 55: Asia Pacific Excluding China Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Sales Channel

Table 56: Asia Pacific Excluding China Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Sales Channel

Table 57: Asia Pacific Excluding China Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Country

Table 58: Asia Pacific Excluding China Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Country

Table 59: Oceania Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Source

Table 60: Oceania Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Source

Table 61: Oceania Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Product

Table 62: Oceania Dairy Alternatives Historical Market Volume (MT) 2014-2018 and Forecast 2019-2029 by Product

Table 63: Oceania Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Nature

Table 64: Oceania Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Nature

Table 65: Oceania Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Sales Channel

Table 66: Oceania Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Sales Channel

Table 67: Oceania Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Country

Table 68: Oceania Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Country

Table 69: MEA Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Source

Table 70: MEA Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Source

Table 71: MEA Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Product

Table 72: MEA Dairy Alternatives Historical Market Volume (MT) 2014-2018 and Forecast 2019-2029 by Product

Table 73: MEA Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Nature

Table 74: MEA Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Nature

Table 75: MEA Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Sales Channel

Table 76: MEA Dairy Alternatives Historical Market Size (MT) 2014-2018 and Forecast 2019-2029 by Sales Channel

Table 77: MEA Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Country

Table 78: MEA Dairy Alternatives Historical Market Size (US$ Mn) 2014-2018 and Forecast 2019-2029 by Country

List of Figures

Figure 01: Global Dairy Alternatives Market Size (US$ Mn) and Volume (Metric Tons) Forecast, 2019–2029

Figure 02: Global Dairy Alternatives Market Absolute $ Opportunity, 2019–2029

Figure 03: Global Dairy Alternatives Market Share Analysis by Source, 2019 and 2029

Figure 04: Global Dairy Alternatives Market Y-o-Y Growth Analysis by Source, 2019–2029

Figure 05: Global Dairy Alternatives Market Attractiveness Analysis by Source, 2019–2029

Figure 06: Global Dairy Alternatives Market Share Analysis by Product, 2019 and 2029

Figure 07: Global Dairy Alternatives Market Y-o-Y Growth Analysis by Product, 2019–2029

Figure 08: Global Dairy Alternatives Market Attractiveness Analysis by Product, 2019–2029

Figure 09: Global Dairy Alternatives Market Share Analysis by Nature, 2019 and 2029

Figure 10: Global Dairy Alternatives Market Y-o-Y Growth Analysis by Nature, 2019–2029

Figure 11: Global Dairy Alternatives Market Attractiveness Analysis by Nature, 2019–2029

Figure 12: Global Dairy Alternatives Market Share Analysis by Sales Channel, 2019 and 2029

Figure 13: Global Dairy Alternatives Market Y-o-Y Growth Analysis by Sales Channel, 2019–2029

Figure 14: Global Dairy Alternatives Market Attractiveness Analysis by Sales Channel, 2019–2029

Figure 15: Global Dairy Alternatives Market Share Analysis by Region, 2019 and 2029

Figure 16: Global Dairy Alternatives Market Y-o-Y Growth Analysis by Region, 2019–2029

Figure 17: Global Dairy Alternatives Market Attractiveness Analysis by Region, 2019–2029

Figure 18: North America Dairy Alternatives Market Share Analysis by Source, 2019 and 2029

Figure 19: North America Dairy Alternatives Market Y-o-Y Growth Analysis by Source, 2019–2029

Figure 20: North America Dairy Alternatives Market Attractiveness Analysis by Source, 2019–2029

Figure 21: North America Dairy Alternatives Market Share Analysis by Product, 2019 and 2029

Figure 22: North America Dairy Alternatives Market Y-o-Y Growth Analysis by Product, 2019–2029

Figure 23: North America Dairy Alternatives Market Attractiveness Analysis by Product, 2019–2029

Figure 24: North America Dairy Alternatives Market Share Analysis by Nature, 2019 and 2029

Figure 25: North America Dairy Alternatives Market Y-o-Y Growth Analysis by Nature, 2019–2029

Figure 26: North America Dairy Alternatives Market Attractiveness Analysis by Nature, 2019–2029

Figure 27: North America Dairy Alternatives Market Share Analysis by Sales Channel, 2019 and 2029

Figure 28: North America Dairy Alternatives Market Y-o-Y Growth Analysis by Sales Channel, 2019–2029

Figure 29: North America Dairy Alternatives Market Attractiveness Analysis by Sales Channel, 2019–2029

Figure 30: North America Dairy Alternatives Market Share Analysis by Country, 2019 and 2029

Figure 31: North America Dairy Alternatives Market Y-o-Y Growth Analysis by Country, 2019–2029

Figure 32: North America Dairy Alternatives Market Attractiveness Analysis by Country, 2019–2029

Figure 33: Latin America Dairy Alternatives Market Share Analysis by Source, 2019 and 2029

Figure 34: Latin America Dairy Alternatives Market Y-o-Y Growth Analysis by Source, 2019–2029

Figure 35: Latin America Dairy Alternatives Market Attractiveness Analysis by Source, 2019–2029

Figure 36: Latin America Dairy Alternatives Market Share Analysis by Product, 2019 and 2029

Figure 37: Latin America Dairy Alternatives Market Y-o-Y Growth Analysis by Product, 2019–2029

Figure 38: Latin America Dairy Alternatives Market Attractiveness Analysis by Product, 2019–2029

Figure 39: Latin America Dairy Alternatives Market Share Analysis by Nature, 2019 and 2029

Figure 40: Latin America Dairy Alternatives Market Y-o-Y Growth Analysis by Nature, 2019–2029

Figure 41: Latin America Dairy Alternatives Market Attractiveness Analysis by Nature, 2019–2029

Figure 42: Latin America Dairy Alternatives Market Share Analysis by Sales Channel, 2019 and 2029

Figure 43: Latin America Dairy Alternatives Market Y-o-Y Growth Analysis by Sales Channel, 2019–2029

Figure 44: Latin America Dairy Alternatives Market Attractiveness Analysis by Sales Channel, 2019–2029

Figure 45: Latin America Dairy Alternatives Market Share Analysis by Country, 2019 and 2029

Figure 46: Latin America Dairy Alternatives Market Y-o-Y Growth Analysis by Country, 2019–2029

Figure 47: Latin America Dairy Alternatives Market Attractiveness Analysis by Country, 2019–2029

Figure 48: Europe Dairy Alternatives Market Share Analysis by Source, 2019 and 2029

Figure 49: Europe Dairy Alternatives Market Y-o-Y Growth Analysis by Source, 2019–2029

Figure 50: Europe Dairy Alternatives Market Attractiveness Analysis by Source, 2019–2029

Figure 51: Europe Dairy Alternatives Market Share Analysis by Product, 2019 and 2029

Figure 52: Europe Dairy Alternatives Market Y-o-Y Growth Analysis by Product, 2019–2029

Figure 53: Europe Dairy Alternatives Market Attractiveness Analysis by Product, 2019–2029

Figure 54: Europe Dairy Alternatives Market Share Analysis by Nature, 2019 and 2029

Figure 55: Europe Dairy Alternatives Market Y-o-Y Growth Analysis by Nature, 2019–2029

Figure 56: Europe Dairy Alternatives Market Attractiveness Analysis by Nature, 2019–2029

Figure 57: Europe Dairy Alternatives Market Share Analysis by Sales Channel, 2019 and 2029

Figure 58: Europe Dairy Alternatives Market Y-o-Y Growth Analysis by Sales Channel, 2019–2029

Figure 59: Europe Dairy Alternatives Market Attractiveness Analysis by Sales Channel, 2019–2029

Figure 60: Europe Dairy Alternatives Market Share Analysis by Country, 2019 and 2029

Figure 61: Europe Dairy Alternatives Market Y-o-Y Growth Analysis by Country, 2019–2029

Figure 62: Europe Dairy Alternatives Market Attractiveness Analysis by Country, 2019–2029

Figure 63: China Dairy Alternatives Market Share Analysis by Source, 2019 and 2029

Figure 64: China Dairy Alternatives Market Y-o-Y Growth Analysis by Source, 2019–2029

Figure 65: China Dairy Alternatives Market Attractiveness Analysis by Source, 2019–2029

Figure 66: China Dairy Alternatives Market Share Analysis by Product, 2019 and 2029

Figure 67: China Dairy Alternatives Market Y-o-Y Growth Analysis by Product, 2019–2029

Figure 68: China Dairy Alternatives Market Attractiveness Analysis by Product, 2019–2029

Figure 69: China Dairy Alternatives Market Share Analysis by Nature, 2019 and 2029

Figure 70: China Dairy Alternatives Market Y-o-Y Growth Analysis by Nature, 2019–2029

Figure 71: China Dairy Alternatives Market Attractiveness Analysis by Nature, 2019–2029

Figure 72: China Dairy Alternatives Market Share Analysis by Sales Channel, 2019 and 2029

Figure 73: China Dairy Alternatives Market Y-o-Y Growth Analysis by Sales Channel, 2019–2029

Figure 74: China Dairy Alternatives Market Attractiveness Analysis by Sales Channel, 2019–2029

Figure 75: China Dairy Alternatives Market Share Analysis by Country, 2019 and 2029

Figure 76: Asia Pacific Excluding China Dairy Alternatives Market Share Analysis by Source, 2019 and 2029

Figure 77: Asia Pacific Excluding China Dairy Alternatives Market Y-o-Y Growth Analysis by Source, 2019–2029

Figure 78: Asia Pacific Excluding China Dairy Alternatives Market Attractiveness Analysis by Source, 2019–2029

Figure 79: Asia Pacific Excluding China Dairy Alternatives Market Share Analysis by Product, 2019 and 2029

Figure 80: Asia Pacific Excluding China Dairy Alternatives Market Y-o-Y Growth Analysis by Product, 2019–2029

Figure 81: Asia Pacific Excluding China Dairy Alternatives Market Attractiveness Analysis by Product, 2019–2029

Figure 82: Asia Pacific Excluding China Dairy Alternatives Market Share Analysis by Nature, 2019 and 2029

Figure 83: Asia Pacific Excluding China Dairy Alternatives Market Y-o-Y Growth Analysis by Nature, 2019–2029

Figure 84: Asia Pacific Excluding China Dairy Alternatives Market Attractiveness Analysis by Nature, 2019–2029

Figure 85: Asia Pacific Excluding China Dairy Alternatives Market Share Analysis by Sales Channel, 2019 and 2029

Figure 86: Asia Pacific Excluding China Dairy Alternatives Market Y-o-Y Growth Analysis by Sales Channel, 2019–2029

Figure 87: Asia Pacific Excluding China Dairy Alternatives Market Attractiveness Analysis by Sales Channel, 2019–2029

Figure 88: Asia Pacific Excluding China Dairy Alternatives Market Share Analysis by Country, 2019 and 2029

Figure 89: Asia Pacific Excluding China Dairy Alternatives Market Y-o-Y Growth Analysis by Country, 2019–2029

Figure 90: Asia Pacific Excluding China Dairy Alternatives Market Attractiveness Analysis by Country, 2019–2029

Figure 91: Oceania Dairy Alternatives Market Share Analysis by Source, 2019 and 2029

Figure 92: Oceania Dairy Alternatives Market Y-o-Y Growth Analysis by Source, 2019–2029

Figure 93: Oceania Dairy Alternatives Market Attractiveness Analysis by Source, 2019–2029

Figure 94: Oceania Dairy Alternatives Market Share Analysis by Product, 2019 and 2029

Figure 95: Oceania Dairy Alternatives Market Y-o-Y Growth Analysis by Product, 2019–2029

Figure 96: Oceania Dairy Alternatives Market Attractiveness Analysis by Product, 2019–2029

Figure 97: Oceania Dairy Alternatives Market Share Analysis by Nature, 2019 and 2029

Figure 98: Oceania Dairy Alternatives Market Y-o-Y Growth Analysis by Nature, 2019–2029

Figure 99: Oceania Dairy Alternatives Market Attractiveness Analysis by Nature, 2019–2029

Figure 100: Oceania Dairy Alternatives Market Share Analysis by Sales Channel, 2019 and 2029

Figure 101: Oceania Dairy Alternatives Market Y-o-Y Growth Analysis by Sales Channel, 2019–2029

Figure 102: Oceania Dairy Alternatives Market Attractiveness Analysis by Sales Channel, 2019–2029

Figure 103: Oceania Dairy Alternatives Market Share Analysis by Country, 2019 and 2029

Figure 104: Oceania Dairy Alternatives Market Y-o-Y Growth Analysis by Country, 2019–2029

Figure 105: Oceania Dairy Alternatives Market Attractiveness Analysis by Country, 2019–2029

Figure 106: MEA Dairy Alternatives Market Share Analysis by Source, 2019 and 2029

Figure 107: MEA Dairy Alternatives Market Y-o-Y Growth Analysis by Source, 2019–2029

Figure 108: MEA Dairy Alternatives Market Attractiveness Analysis by Source, 2019–2029

Figure 109: MEA Dairy Alternatives Market Share Analysis by Product, 2019 and 2029

Figure 110: MEA Dairy Alternatives Market Y-o-Y Growth Analysis by Product, 2019–2029

Figure 111: MEA Dairy Alternatives Market Attractiveness Analysis by Product, 2019–2029

Figure 112: MEA Dairy Alternatives Market Share Analysis by Nature, 2019 and 2029

Figure 113: MEA Dairy Alternatives Market Y-o-Y Growth Analysis by Nature, 2019–2029

Figure 114: MEA Dairy Alternatives Market Attractiveness Analysis by Nature, 2019–2029

Figure 115: MEA Dairy Alternatives Market Share Analysis by Sales Channel, 2019 and 2029

Figure 116: MEA Dairy Alternatives Market Y-o-Y Growth Analysis by Sales Channel, 2019–2029

Figure 117: MEA Dairy Alternatives Market Attractiveness Analysis by Sales Channel, 2019–2029

Figure 118: MEA Dairy Alternatives Market Share Analysis by Country, 2019 and 2029

Figure 119: MEA Dairy Alternatives Market Y-o-Y Growth Analysis by Country, 2019–2029

Figure 120: MEA Dairy Alternatives Market Attractiveness Analysis by Country, 2019–2029