The growing uncertainty stemming from the COVID-19 crisis is affecting business activities in the carboxymethyl cellulose market. Nevertheless, coronavirus cases are dropping significantly across regions, except for the U.K. and Russia. Since India completed 1 billion vaccine doses, market stakeholders are keen on investments in this region. Manufacturers are focusing on mission-critical applications in the food & beverages (F&B), oilfield, and pharmaceutical industries to keep economies running.

Companies in the carboxymethyl cellulose market are ensuring robust supply chains by maintaining sufficient inventory levels of raw materials. They are adopting contingency planning to efficiently-manage finances and taking advantage of government stimulus packages to stay financially afloat.

To gauge the scope of customization in our reports Ask for a Sample

Cosmetics, construction industry, and dental applications are triggering the demand for carboxymethyl cellulose (CMC). However, the application of CMC in these fields highly depends upon the purity, degree of polymerization (DP), and degree of substitution (DS), which govern the performance of the resulting products. Therefore, the characterization of a CMC product is an essential step for determining its further applications and marketization in different areas.

Characterization techniques such as thermo-gravimetric analysis (TGA) and fourier transformation infrared ray (FTIR) spectroscopy help to determine, which CMC product is suitable for a given application. Abundance of raw materials and low cost synthesis of CMC is translating into revenue opportunities for manufacturers. Paper, textile, and biomedical engineering applications are contributing for market expansion.

Get an idea about the offerings of our report from Report Brochure

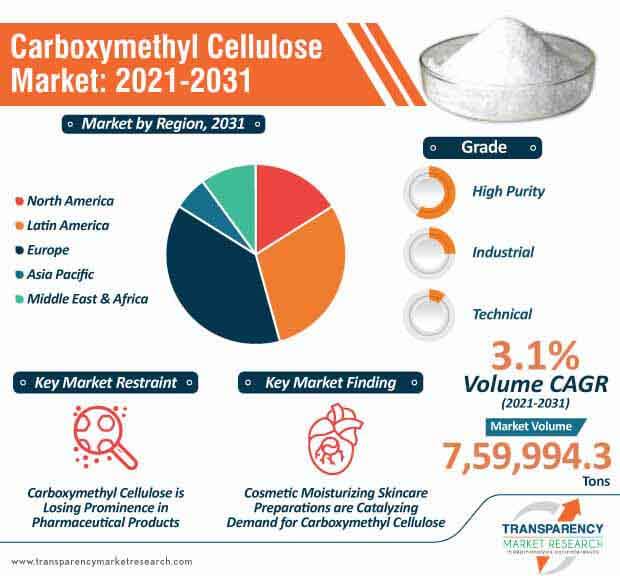

Personal care products and cosmetics are creating value-grab opportunities for manufacturers in the carboxymethyl cellulose market. CMC is gaining prominence in hair care products, hair grooming aids, and shampoos. Cosmetic moisturizing skincare preparations, creams, and lotions are catalyzing the demand for carboxymethyl cellulose. Manufacturers are boosting their output capacities to produce cold creams, hand skincare preparations, and makeup foundations. Eye-shadow blushers and eyeliners are triggering the demand for CMC.

Toothpaste formulations are creating stable revenue streams for manufacturers in the carboxymethyl cellulose market. Regular white, translucent clear gels, and tartar control toothpastes are fueling the demand for carboxymethyl cellulose. This explains why the market is projected to cross US$ 1.85 Bn by 2031. Manufacturers are developing cellulose gums that easily dissolve in water for toothpaste formulations.

Agriculture waste-derived carboxymethyl cellulose holds promising potentials as a biodegradable material for sustainable packaging. Such findings are generating income sources for manufacturers in the carboxymethyl cellulose market, since there is a growing demand for value added materials in sustainable packaging applications. Agriculture waste-derived carboxymethyl cellulose has the ability to reduce the cost involved in the development of films.

Many Indian states have imposed a ban on single-use plastics. Such trends are bolstering growth in the India carboxymethyl cellulose market, as this plastic ban will encourage the use of sustainable materials.

The carboxymethyl cellulose market is expected to grow at a CAGR of 3.6% during the forecast period. Since agricultural waste or by-products are blamed for massive litter in the environment, manufacturers are increasing R&D in agriculture waste-derived carboxymethyl cellulose to develop sustainable packaging materials.

On the other hand, food ingredients, ceramics, and detergents are catalyzing the demand for CMC. Manufacturers in the carboxymethyl cellulose market are increasing the production of high-purity grades CMC in food and pharmaceutical industries.

Since U.S. and Rwanda have banned the use of plastic bags, microplastics, and styrofoam, the demand for agriculture waste-derived carboxymethyl cellulose is driving the production of sustainable packaging materials. This has enabled maximum protection against the plastic microbead pollution. Agriculture waste-derived CMC for sustainable packaging materials is found to have high mechanical strength.

Looking for Regional Analysis or Competitive Landscape in Carboxymethyl Cellulose Market for Performance OEM , ask for a customized report

Analysts’ Viewpoint

Manufacturers in the carboxymethyl cellulose market are entering the plug and play mode to adapt to changing demand sentiments of consumers during ongoing COVID-19 crisis. It has been found that high-cost purified pharmaceutical grade CMC products are not necessary for applications in construction, plastic, or oil industries. Hence, manufacturers in the carboxymethyl cellulose market should enable characterization of a CMC product such as the scanning electron microscopic (SEM) analysis technique for determining its further applications and marketization in different areas. The internal sugar ring structure of CMC has an excellent skeleton effect as a composite structure that can improvise tensile strength in agriculture waste-derived sustainable packaging materials.

|

Attribute |

Detail |

|

Market Size Value in 2020 |

US$ 1.26 Bn |

|

Market Forecast Value in 2031 |

US$ 1.85 Bn |

|

Growth Rate (CAGR) |

3.6% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value & Tons for Volume |

|

Market Analysis |

It includes segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

Carboxymethyl Cellulose Market – Segmentation

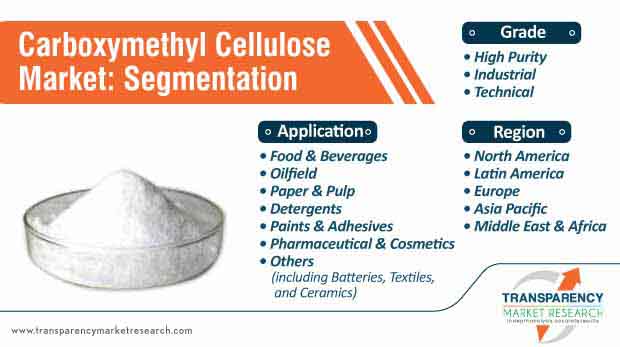

TMR’s research study assesses the global carboxymethyl cellulose market in terms of grade, application, and region. This report presents extensive market dynamics and trends associated with different segments of the market and how they are influencing growth prospects for the global carboxymethyl cellulose market.

| Grade |

|

| Application |

|

| Region |

|

Carboxymethyl Cellulose Market is expected to reach US$ 1.85 Bn By 2031

Carboxymethyl Cellulose Market is estimated to rise at a CAGR of 3.6% during forecast period

Rise in awareness about healthy food among consumers and increase in demand for food and beverages across the globe are major factors driving the demand for carboxymethyl cellulose market

Key players operating in the global carboxymethyl cellulose market are Nouryon Chemicals Holding B.V., DuPont de Nemours, Inc., CP Kelco, Ashland Inc., Jining Fortune Biotech Co., Ltd., Nippon Paper Industries Co., Ltd., Daicel Corporation, Dai-Ichi Kogyo Seiyaku Co., Ltd, and Quimica Amtex S.A De C.V.

Food & Beverages, Oilfield, Paper & Pulp, Detergents, Paints & Adhesives, Pharmaceutical & Cosmetics are the application segments in the Carboxymethyl Cellulose Market

1. Executive Summary

1.1. Carboxymethyl Cellulose Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Potential Customers

3. COVID-19 Impact Analysis

4. Carboxymethyl Cellulose Market Production Outlook

5. Carboxymethyl Cellulose Price Trend Analysis, 2020–2031

5.1. By Grade

5.2. By Application

5.3. By Region

6. Global Carboxymethyl Cellulose Market Analysis and Forecast, by Grade, 2020–2031

6.1. Introduction and Definitions

6.2. Global Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

6.2.1. High Purity

6.2.2. Industrial

6.2.3. Technical

6.3. Global Carboxymethyl Cellulose Market Attractiveness, by Grade

7. Global Carboxymethyl Cellulose Market Analysis and Forecast, by Application, 2020–2031

7.1. Introduction and Definitions

7.2. Global Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.2.1. Food & Beverages

7.2.2. Oilfield

7.2.3. Paper & Pulp

7.2.4. Detergents

7.2.5. Paints & Adhesives

7.2.6. Pharmaceutical & Cosmetics

7.2.7. Others

7.3. Global Carboxymethyl Cellulose Market Attractiveness, by Application

8. Global Carboxymethyl Cellulose Market Analysis and Forecast, by Region, 2020–2031

8.1. Key Findings

8.2. Global Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Carboxymethyl Cellulose Market Attractiveness, by Region

9. North America Carboxymethyl Cellulose Market Analysis and Forecast, 2020–2031

9.1. Key Findings

9.2. North America Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

9.3. North America Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4. North America Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

9.4.1. U.S. Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

9.4.2. U.S. Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4.3. Canada Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

9.4.4. Canada Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.5. North America Carboxymethyl Cellulose Market Attractiveness Analysis

10. Europe Carboxymethyl Cellulose Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Europe Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.3. Europe Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4. Europe Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

10.4.1. Germany Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.2. Germany Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.3. France Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.4. France Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.5. U.K. Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.6. U.K. Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.7. Italy Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.8. Italy Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.9. Spain Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.10. Spain Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.11. Portugal Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.12. Portugal Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.13. Russia & CIS Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.14. Russia & CIS Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.15. Rest of Europe Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

10.4.16. Rest of Europe Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5. Europe Carboxymethyl Cellulose Market Attractiveness Analysis

11. Asia Pacific Carboxymethyl Cellulose Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Asia Pacific Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.3. Asia Pacific Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4. Asia Pacific Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

11.4.1. China Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.4.2. China Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.3. Japan Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.4.4. Japan Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.5. India Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.4.6. India Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.7. South Korea Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.4.8. South Korea Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.9. ASEAN Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.4.10. ASEAN Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.11. Rest of Asia Pacific Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

11.4.12. Rest of Asia Pacific Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5. Asia Pacific Carboxymethyl Cellulose Market Attractiveness Analysis

12. Latin America Carboxymethyl Cellulose Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Latin America Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

12.3. Latin America Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4. Latin America Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

12.4.1. Brazil Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

12.4.2. Brazil Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4.3. Mexico Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

12.4.4. Mexico Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4.5. Rest of Latin America Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

12.4.6. Rest of Latin America Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5. Latin America Carboxymethyl Cellulose Market Attractiveness Analysis

13. Middle East & Africa Carboxymethyl Cellulose Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Middle East & Africa Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

13.3. Middle East & Africa Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4. Middle East & Africa Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

13.4.1. GCC Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

13.4.2. GCC Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4.3. South Africa Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

13.4.4. South Africa Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4.5. Rest of Middle East & Africa Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

13.4.6. Rest of Middle East & Africa Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5. Middle East & Africa Carboxymethyl Cellulose Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Carboxymethyl Cellulose Company Market Share Analysis, 2020

14.2. Competition Matrix

14.3. Market Footprint Analysis

14.3.1. By Grade

14.3.2. By Application

14.4. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.4.1. Nouryon Chemicals Holding B.V.

14.4.1.1. Company Description

14.4.1.2. Business Overview

14.4.1.3. Financial Details

14.4.1.4. Strategic Overview

14.4.2. CP Kelco

14.4.2.1. Company Description

14.4.2.2. Business Overview

14.4.2.3. Financial Details

14.4.2.4. Strategic Overview

14.4.3. DuPont de Nemours, Inc.

14.4.3.1. Company Description

14.4.3.2. Business Overview

14.4.3.3. Financial Details

14.4.3.4. Strategic Overview

14.4.4. Jining Fortune Biotech Co., Ltd.

14.4.4.1. Company Description

14.4.4.2. Business Overview

14.4.4.3. Financial Details

14.4.4.4. Strategic Overview

14.4.5. Ashland Inc.

14.4.5.1. Company Description

14.4.5.2. Business Overview

14.4.5.3. Financial Details

14.4.5.4. Strategic Overview

14.4.6. Lamberti S.p.A.

14.4.6.1. Company Description

14.4.6.2. Business Overview

14.4.6.3. Financial Details

14.4.6.4. Strategic Overview

14.4.7. Jining Fortune Biotech Co., Ltd.

14.4.7.1. Company Description

14.4.7.2. Business Overview

14.4.7.3. Financial Details

14.4.7.4. Strategic Overview

14.4.8. Nippon Paper Industries Co., Ltd.

14.4.8.1. Company Description

14.4.8.2. Business Overview

14.4.8.3. Financial Details

14.4.8.4. Strategic Overview

14.4.9. Daicel Corporation

14.4.9.1. Company Description

14.4.9.2. Business Overview

14.4.9.3. Financial Details

14.4.9.4. Strategic Overview

14.4.10. Dai-Ichi Kogyo Seiyaku Co., Ltd.

14.4.10.1. Company Description

14.4.10.2. Business Overview

14.4.10.3. Financial Details

14.4.10.4. Strategic Overview

14.4.11. Quimica Amtex S.A De C.V.

14.4.11.1. Company Description

14.4.11.2. Business Overview

14.4.11.3. Financial Details

14.4.11.4. Strategic Overview

14.4.12. Akzo Nobel N.V.

14.4.12.1. Company Description

14.4.12.2. Business Overview

14.4.12.3. Financial Details

14.4.12.4. Strategic Overview

14.4.13. Ugur Seluloz Kimya A.S.

14.4.13.1. Company Description

14.4.13.2. Business Overview

14.4.13.3. Financial Details

14.4.13.4. Strategic Overview

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 2: Global Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 3: Global Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 4: Global Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 5: Global Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Region, 2020–2031

Table 6: Global Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Region, 2020–2031

Table 7: North America Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 8: North America Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 9: North America Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 10: North America Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 11: North America Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Country, 2020–2031

Table 12: North America Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 13: U.S. Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 14: U.S. Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 15: U.S. Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 16: U.S. Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 17: Canada Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 18: Canada Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 19: Canada Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 20: Canada Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 21: Europe Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 22: Europe Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 23: Europe Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 24: Europe Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 25: Europe Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Country, 2020–2031

Table 26: Europe Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 27: Germany Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 28: Germany Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 29: Germany Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 30: Germany Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 31: France Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 32: France Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 33: France Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 34: France Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 35: U.K. Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 36: U.K. Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 37: U.K. Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 38: U.K. Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 39: Spain Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 40: Spain Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 41: Spain Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 42: Spain Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 43: Portugal Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 44: Portugal Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 45: Portugal Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 46: Portugal Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 47: Russia & CIS Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 48: Russia & CIS Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 49: Russia & CIS Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 50: Russia & CIS Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 51: Rest of Europe Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 52: Rest of Europe Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 53: Rest of Europe Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 54: Rest of Europe Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 55: Asia Pacific Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 56: Asia Pacific Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 57: Asia Pacific Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 58: Asia Pacific Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 59: Asia Pacific Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Country, 2020–2031

Table 60: Asia Pacific Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 61: China Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 62: China Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 63: China Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 64: China Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 65: Japan Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 66: Japan Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 67: Japan Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 68: Japan Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 69: India Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 70: India Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 71: India Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 72: India Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 73: ASEAN Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 74: ASEAN Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 75: ASEAN Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 76: ASEAN Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 77: Rest of Asia Pacific Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 78: Rest of Asia Pacific Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 79: Rest of Asia Pacific Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 80: Rest of Asia Pacific Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020-2031

Table 81: Latin America Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 82: Latin America Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 83: Latin America Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 84: Latin America Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 85: Latin America Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Country, 2020–2031

Table 86: Latin America Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 87: Brazil Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 88: Brazil Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 89: Brazil Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 90: Brazil Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 91: Mexico Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 92: Mexico Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 93: Mexico Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 94: Mexico Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 95: Rest of Latin America Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 96: Rest of Latin America Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 97: Rest of Latin America Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020-2031

Table 98: Rest of Latin America Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020-2031

Table 99: Middle East & Africa Carboxymethyl Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 100: Middle East & Africa Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 101: Middle East & Africa Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 102: Middle East & Africa Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 103: Middle East & Africa Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 104: Middle East & Africa Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Country, 2020–2031

Table 105: Middle East & Africa Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 106: GCC Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 107: GCC Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 108: GCC Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 109: GCC Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 110: South Africa Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 111: South Africa Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 112: South Africa Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020–2031

Table 113: South Africa Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 114: Rest of Middle East & Africa Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Grade, 2020–2031

Table 115: Rest of Middle East & Africa Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 116: Rest of Middle East & Africa Carboxymethyl Cellulose Market Volume (Tons) Forecast, by Application, 2020-2031

Table 117: Rest of Middle East & Africa Carboxymethyl Cellulose Market Value (US$ Mn) Forecast, by Application, 2020-2031

List of Figures

Figure 1: Global Carboxymethyl Cellulose Market Share Analysis, by Grade

Figure 2: Global Carboxymethyl Cellulose Market Attractiveness Analysis, by Grade

Figure 3: Global Carboxymethyl Cellulose Market Share Analysis, by Application

Figure 4: Global Carboxymethyl Cellulose Market Attractiveness Analysis, by Application

Figure 5: Global Carboxymethyl Cellulose Market Share Analysis, by Region

Figure 6: Global Carboxymethyl Cellulose Market Attractiveness Analysis, by Region

Figure 7: North America Carboxymethyl Cellulose Market Share Analysis, by Grade

Figure 8: North America Carboxymethyl Cellulose Market Attractiveness Analysis, by Grade

Figure 9: North America Carboxymethyl Cellulose Market Share Analysis, by Application

Figure 10: North America Carboxymethyl Cellulose Market Attractiveness Analysis, by Application

Figure 11: North America Carboxymethyl Cellulose Market Share Analysis, by Country

Figure 12: Europe Carboxymethyl Cellulose Market Attractiveness Analysis, by Country and Sub-region

Figure 13: Europe Carboxymethyl Cellulose Market Share Analysis, by Grade

Figure 14: Europe Carboxymethyl Cellulose Market Attractiveness Analysis, by Grade

Figure 15: Europe Carboxymethyl Cellulose Market Share Analysis, by Application

Figure 16: Europe Carboxymethyl Cellulose Market Attractiveness Analysis, by Application

Figure 17: Europe Carboxymethyl Cellulose Market Share Analysis, by Country and Sub-region

Figure 18: Europe Carboxymethyl Cellulose Market Attractiveness Analysis, by Country and Sub-region

Figure 19: Asia Pacific Carboxymethyl Cellulose Market Share Analysis, by Grade

Figure 20: Asia Pacific Carboxymethyl Cellulose Market Attractiveness Analysis, by Grade

Figure 21: Asia Pacific Carboxymethyl Cellulose Market Share Analysis, by Application

Figure 22: Asia Pacific Carboxymethyl Cellulose Market Attractiveness Analysis, by Application

Figure 23: Asia Pacific Carboxymethyl Cellulose Market Share Analysis, by Country and Sub-region

Figure 24: Asia Pacific Carboxymethyl Cellulose Market Attractiveness Analysis, by Country and Sub-region

Figure 25: Latin America Carboxymethyl Cellulose Market Share Analysis, by Grade

Figure 26: Latin America Carboxymethyl Cellulose Market Attractiveness Analysis, by Grade

Figure 27: Latin America Carboxymethyl Cellulose Market Share Analysis, by Application

Figure 28: Latin America Carboxymethyl Cellulose Market Attractiveness Analysis, by Application

Figure 29: Latin America Carboxymethyl Cellulose Market Share Analysis, by Country and Sub-region

Figure 30: Latin America Carboxymethyl Cellulose Market Attractiveness Analysis, by Country and Sub-region

Figure 31: Middle East & Africa Carboxymethyl Cellulose Market Share Analysis, by Grade

Figure 32: Middle East & Africa Carboxymethyl Cellulose Market Attractiveness Analysis, by Grade

Figure 33: Middle East & Africa Carboxymethyl Cellulose Market Share Analysis, by Application

Figure 34: Middle East & Africa Carboxymethyl Cellulose Market Attractiveness Analysis, by Application

Figure 35: Middle East & Africa Carboxymethyl Cellulose Market Share Analysis, by Country and Sub-region

Figure 36: Middle East & Africa Carboxymethyl Cellulose Market Attractiveness Analysis, by Country and Sub-region