The global atomic layer deposition (ALD) market has reported strong growth in the last few years. Transparency Market Research (TMR) forecasts that the market will continue to exhibiting steady growth between 2016 and 2024 as the use of the ALD technology increases in the production of smartphones, DVD players, printers, and other electronics. A few of the key applications of atomic layer deposition include industrial, biomedical, video games, portable media players, microelectronics, and quality control.

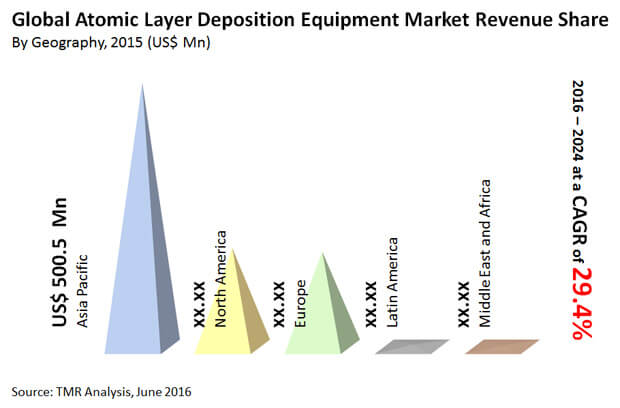

The global ALD equipment market stood at US$875.0 mn in 2015. Exhibiting a CAGR of 29.4% between 2016 and 2024, the market is poised to reach US$8.58 bn by the end of 2024.

Industrial Expansion to Create New Opportunities for ALD Equipment in Asia Pacific

From the geographic standpoint, North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa constitute the most lucrative markets for ALD equipment. Among these, Asia Pacific has emerged as the leading regional market due to the increasing application of ALD across core industries. The region held approximately 57.2% of the global ALD equipment market in 2015 in terms of revenue.

As per TMR, the rapid expansion of the automotive, electronics, and semiconductor industries will stimulate demand for ALD equipment in Asia Pacific. The regional market is also likely to gain from the rising demand from medical centers. According to TMR, the Asia Pacific ALD market, which stood at US$500.5 mn in 2015, is expected to reach US$5.1 bn by the end of 2024. The market is expected to exhibit a CAGR of 29.9% during the forecast period. The increasing use of ALD equipment across industrial set ups is also expected to boost its sales in North America.

Applications in Nanotechnology to Boost Opportunities for ALD Equipment Market

In the last few years, the use of atomic layer deposition has significantly increased in nanotechnology. The recent technological advancements in the ALD technology in terms of scalability, performance, and reliability have made this possible. With the advent of more advanced technologies, the usage of ALD equipment as manipulation and fabrication tools in nanotechnology is expected to accelerate. Furthermore, the sales of ALD equipment are poised to surge due to the rising demand for less time consuming and effective semiconductor equipment manufacturing process.

However, the process of ALD is very time consuming, which indirectly acts as a growth suppressant for the ALD equipment sales. The stringent export control regulations are also expected to create bottlenecks for the market. Besides this, the high initial investment required for ALD equipment and the lack of skilled workforce also inhibit the growth in ALD equipment sales to an extent.

Nevertheless, the increasing applications of ALD in semiconductor and electronics and energy devices is expected to keep the demand for ALD equipment high in the forthcoming years. The increasing research and development on atomic layer deposition technologies is projected to boost opportunities for the ALD equipment market. The market is also expected to significantly gain from the increasing application of atomic layer deposition in power devices and energy storage devices.

Rising Use in Semiconductor and Electronics Industry to Fuel Demand for ALD Equipment

Based on application, research and development facilities and semiconductor and electronics constitute the two key segments in the global ALD equipment market. With a share of 87.4%, the semiconductor and electronics segment exhibited the highest demand for ALD equipment in 2015. Due to recent technological advancements, the application of ALD equipment across medical, industrial, and automotive sectors has significantly increased. This, in turn, has fuelled demand for ALD equipment from the semiconductor and electronics segment.

Some of the key players in the ALD equipment market are ASM International N.V. (The Netherlands), Entegris, Inc. (The U.S.), Aixtron SE (Germany), CVD Equipment Corporation (U.S.), Picosun Oy (Finland), Arradiance, Inc. (The U.S.), Beneq Oy (Finland), ALD Nanosolutions, Inc. (The U.S.), Veeco Instruments, Inc. (The U.S.), Oxford Instruments Plc (U.K.), SENTECH Instruments GmbH (Germany), Applied Materials, Inc. (The U.S.), Encapsulix (France), Kurt J. Lesker Company (The U.S.), and Ultratech Inc. (The U.S) .

New Technologies to Find Growing Use in R&D in Atomic Layer Deposition Equipment Market

Atomic layer deposition (ALD) equipment is used for depositing thin films. A range of materials can be used for ALD. The process is characterized by the remarkable conformity to high aspect ratio surfaces in various surfaces. They are extensively used in the semiconductor industry for depositing films in forming structures in sensors, memory devices, and micro-electro-mechanical systems. A key drive for atomic layer deposition equipment market is propelled by advances in fabrication technologies for a wide range of semiconductor devices that are used in smart enterprise and commercial applications. Current fabrication methods support smaller and complex substrates films, thereby nudging equipment and platform manufacturers in atomic layer deposition (ALD) equipment market to improve ALD techniques. A lucrative demand in the atomic layer deposition equipment market comes from the application of ALD in coating for protection applications. Numerous industrial applications utilize ALD for depositing protective and functional coatings. An example is fuel cells. Advances in platforms and the software have enabled users to vary different parameters. Further, the adoption of configured safety protocols is a key trend in the currently available ALD platforms.

The COVID-19 pandemic that had struck the world in 2019 is still emerging in some regions. The impacts of the outbreaks have been a mix of devastating public health effects and economic activities. Businesses in 2020 had to shift toward new strategic and operational frameworks for remaining agile in the wake of the growing aftermath. In recent months, numerous industries have been quick to adopt digital technologies and automation in their production units to overcome some of the disruptions. Perhaps, the most virulent and long-term impacts are uncertainty in demands from end consumers, and the businesses in the atomic layer deposition equipment market are not immune to the shifts. Use of ALD in research and development applications in lifesciences industry will spur new growth potential in the next few months. The changing process requirements will also expand the avenue.

Chapter 1 Preface

1.1 Report Description

1.2 Market Scope

1.3 Key Take Away

1.4 Research Methodology

Chapter 2 Executive Summary

2.1 Global Atomic Layer Deposition Equipment Market Snapshot

Chapter 3 Global Atomic Layer Deposition Equipment Market Overview

3.1 Introduction

3.2 Market Dynamics

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.3 Porter’s five forces analysis

3.4 Market attractiveness analysis, by application

3.4.1 Recommendations

3.5 Global Atomic Layer Deposition Equipment Market Analysis, By Type

3.5.1 Overview

3.5.2 Aluminum Oxide (Al2O3) ALD

3.5.3 Catalytic ALD

3.5.4 Metal ALD

3.5.5 ALD on Polymers

3.5.6 Others

3.6 Global Atomic Layer Deposition Equipment Market Analysis, By Applications

3.6.1 Overview

3.6.2 Semiconductor & Electronics

3.6.2.1 Barrier Layers

3.6.2.2 Integrated Circuit (IC)Applications

3.6.2.3 Solar Panels

3.6.2.4 Display Panels

3.6.2.5 Sensors

3.6.2.6 Others

3.6.3 Research & Development Facilities

3.7 Competitive Landscape

3.7.1 Market Positioning of Key Players, 2015

3.7.2 Top 5 ALD equipment supplier to research field

3.7.3 Competitive Strategies Adopted by Leading Players

3.7.4 Patent Analysis

Chapter 4 Global Atomic Layer Deposition Equipment Market 2016 – 2024, Technological Analysis

4.1 Introduction

4.2 Small Substrate Wafer

4.2.1 Technical Specification

4.3 Large Substrate Wafer

4.3.1 Technical Specification

4.4 ALD Applications, Key Trends and Future Outlook

4.4.1 Applications

4.4.2 Key Trends and Future Outlook

4.5 ALD Technology for Small Substrate Wafer Vs ALD Technology for Large Substrate Wafer

4.6 Atomic Layer Deposition in Research & Development Industry

4.6.1 Key Trends Analysis by verticals

4.6.2 Technical Requirements

4.6.3 Emerging Trends

4.6.4 Future Growth Opportunities

4.7 Technology Comparison

4.7.1 Types

4.7.1.1 Atomic Layer Deposition

4.7.1.2 Chemical Vapor Deposition

4.7.1.3 Physical Vapor Deposition

4.7.2 ALD Vs CVD Vs PVD

Chapter 5 North America Atomic Layer Deposition Equipment Market Analysis, 2016 – 2024

5.1 Key Trends Analysis

5.2 North America Atomic Layer Deposition Equipment Market Analysis, By Type, 2016 – 2024

5.2.1 Overview

5.2.2 Aluminum Oxide (Al2O3) ALD

5.2.3 Catalytic ALD

5.2.4 Metal ALD

5.2.5 ALD on Polymers

5.2.6 Others

5.3 North America Atomic Layer Deposition Equipment Market Analysis, By Applications, 2016 – 2024

5.3.1 Overview

5.3.2 Semiconductor & Electronics

5.3.2.1 Barrier Layers

5.3.2.2 Integrated Circuit (IC)Applications

5.3.2.3 Solar Panels

5.3.2.4 Display Panels

5.3.2.5 Sensors

5.3.2.6 Others

5.3.3 Research & Development Facilities

5.4 North America Atomic Layer Deposition Equipment Market Analysis, By Country, 2016 – 2024

Chapter 6 Europe Atomic Layer Deposition Equipment Market Analysis, 2016 – 2024

6.1 Key Trends Analysis

6.2 Europe Atomic Layer Deposition Equipment Market Analysis, By Type, 2016 – 2024

6.2.1 Overview

6.2.2 Aluminum Oxide (Al2O3) ALD

6.2.3 Catalytic ALD

6.2.4 Metal ALD

6.2.5 ALD on Polymers

6.2.6 Others

6.3 Europe Atomic Layer Deposition Equipment Market Analysis, By Applications, 2016 – 2024

6.3.1 Overview

6.3.2 Semiconductor & Electronics

6.3.2.1 Barrier Layers

6.3.2.2 Integrated Circuit (IC)Applications

6.3.2.3 Solar Panels

6.3.2.4 Display Panels

6.3.2.5 Sensors

6.3.2.6 Others

6.3.3 Research & Development Facilities

6.4 Europe Atomic Layer Deposition Equipment Market Analysis, By Country, 2016 – 2024

Chapter 7 Asia Pacific Atomic Layer Deposition Equipment Market Analysis, 2016 – 2024

7.1 Key Trends Analysis

7.2 Asia Pacific Atomic Layer Deposition Equipment Market Analysis, By Type, 2016 – 2024

7.2.1 Overview

7.2.2 Aluminum Oxide (Al2O3) ALD

7.2.3 Catalytic ALD

7.2.4 Metal ALD

7.2.5 ALD on Polymers

7.2.6 Others

7.3 Asia Pacific Atomic Layer Deposition Equipment Market Analysis, By Applications, 2016 – 2024

7.3.1 Overview

7.3.2 Semiconductor & Electronics

7.3.2.1 Barrier Layers

7.3.2.2 Integrated Circuit (IC)Applications

7.3.2.3 Solar Panels

7.3.2.4 Display Panels

7.3.2.5 Sensors

7.3.2.6 Others

7.3.3 Research & Development Facilities

7.4 Asia Pacific Atomic Layer Deposition Equipment Market Analysis, By Country, 2016 – 2024

Chapter 8 Middle East and Africa Atomic Layer Deposition Equipment Market Analysis, 2016 – 2024

8.1 Key Trends Analysis

8.2 Middle East and Africa Atomic Layer Deposition Equipment Market Analysis, By Type, 2016 – 2024

8.2.1 Overview

8.2.2 Aluminum Oxide (Al2O3) ALD

8.2.3 Catalytic ALD

8.2.4 Metal ALD

8.2.5 ALD on Polymers

8.2.6 Others

8.3 Middle East and Africa Atomic Layer Deposition Equipment Market Analysis, By Applications, 2016 – 2024

8.3.1 Overview

8.3.2 Semiconductor & Electronics

8.3.2.1 Barrier Layers

8.3.2.2 Integrated Circuit (IC)Applications

8.3.2.3 Solar Panels

8.3.2.4 Display Panels

8.3.2.5 Sensors

8.3.2.6 Others

8.3.3 Research & Development Facilities

Chapter 9 Latin America Atomic Layer Deposition Equipment Market Analysis, 2016 – 2024

9.1 Key Trends Analysis

9.2 Latin America Atomic Layer Deposition Equipment Market Analysis, By Type, 2016 – 2024

9.2.1 Overview

9.2.2 Aluminum Oxide (Al2O3) ALD

9.2.3 Catalytic ALD

9.2.4 Metal ALD

9.2.5 ALD on Polymers

9.2.6 Others

9.3 Latin America Atomic Layer Deposition Equipment Market Analysis, By Applications, 2016 – 2024

9.3.1 Overview

9.3.2 Semiconductor & Electronics

9.3.2.1 Barrier Layers

9.3.2.2 Integrated Circuit (IC)Applications

9.3.2.3 Solar Panels

9.3.2.4 Display Panels

9.3.2.5 Sensors

9.3.2.6 Others

9.3.3 Research & Development Facilities

Chapter 10 Global Atomic Layer Deposition Equipment Market, Country Snippets

10.1 The U.S.

10.2 Canada

10.3 Rest of North America

10.4 The U.K.

10.5 Germany

10.6 France

10.7 Italy

10.8 Rest of Europe

10.9 China

10.10 Japan

10.11 India

10.12 Taiwan

10.13 South Korea

10.14 Rest of Asia Pacific

Chapter 11 Company Profiles

11.1 Aixtron SE

11.1.1 Company Details (HQ, Foundation Year, Employee Strength)

11.1.2 Market Presence, By Segment and Geography

11.1.3 Key Developments

11.1.4 Strategy and Historical Roadmap

11.1.5 Revenue and Operating Profits

11.2 ASM International N.V.

11.2.1 Company Details (HQ, Foundation Year, Employee Strength)

11.2.2 Market Presence, By Segment and Geography

11.2.3 Key Developments

11.2.4 Strategy and Historical Roadmap

11.2.5 Revenue and Operating Profits

11.3 Entegris, Inc.

11.3.1 Company Details (HQ, Foundation Year, Employee Strength)

11.3.2 Market Presence, By Segment and Geography

11.3.3 Key Developments

11.3.4 Strategy and Historical Roadmap

11.3.5 Revenue and Operating Profits

11.4 Picosun Oy

11.4.1 Company Details (HQ, Foundation Year, Employee Strength)

11.4.2 Market Presence, By Segment and Geography

11.4.3 Key Developments

11.4.4 Strategy and Historical Roadmap

11.4.5 Revenue and Operating Profits

11.5 CVD Equipment Corporation

11.5.1 Company Details (HQ, Foundation Year, Employee Strength)

11.5.2 Market Presence, By Segment and Geography

11.5.3 Key Developments

11.5.4 Strategy and Historical Roadmap

11.5.5 Revenue and Operating Profits

11.6 Arradiance, Inc

11.6.1 Company Details (HQ, Foundation Year, Employee Strength)

11.6.2 Market Presence, By Segment and Geography

11.6.3 Key Developments

11.6.4 Strategy and Historical Roadmap

11.6.5 Revenue and Operating Profits

11.7 ALD Nanosolutions, Inc.

11.7.1 Company Details (HQ, Foundation Year, Employee Strength)

11.7.2 Market Presence, By Segment and Geography

11.7.3 Key Developments

11.7.4 Strategy and Historical Roadmap

11.7.5 Revenue and Operating Profits

11.8 Applied Materials, Inc.

11.8.1 Company Details (HQ, Foundation Year, Employee Strength)

11.8.2 Market Presence, By Segment and Geography

11.8.3 Key Developments

11.8.4 Strategy and Historical Roadmap

11.8.5 Revenue and Operating Profits

11.9 Beneq Oy

11.9.1 Company Details (HQ, Foundation Year, Employee Strength)

11.9.2 Market Presence, By Segment and Geography

11.9.3 Key Developments

11.9.4 Strategy and Historical Roadmap

11.9.5 Revenue and Operating Profits

11.10 Veeco Instruments, Inc.

11.10.1 Company Details (HQ, Foundation Year, Employee Strength)

11.10.2 Market Presence, By Segment and Geography

11.10.3 Key Developments

11.10.4 Strategy and Historical Roadmap

11.10.5 Revenue and Operating Profits

11.11 Oxford Instruments Plc

11.11.1 Company Details (HQ, Foundation Year, Employee Strength)

11.11.2 Market Presence, By Segment and Geography

11.11.3 Key Developments

11.11.4 Strategy and Historical Roadmap

11.11.5 Revenue and Operating Profits

11.12 SENTECH Instruments GmbH

11.12.1 Company Details (HQ, Foundation Year, Employee Strength)

11.12.2 Market Presence, By Segment and Geography

11.12.3 Key Developments

11.12.4 Strategy and Historical Roadmap

11.12.5 Revenue and Operating Profits

11.13 Encapsulix

11.13.1 Company Details (HQ, Foundation Year, Employee Strength)

11.13.2 Market Presence, By Segment and Geography

11.13.3 Key Developments

11.13.4 Strategy and Historical Roadmap

11.13.5 Revenue and Operating Profits

11.14 Kurt J. Lesker Company

11.14.1 Company Details (HQ, Foundation Year, Employee Strength)

11.14.2 Market Presence, By Segment and Geography

11.14.3 Key Developments

11.14.4 Strategy and Historical Roadmap

11.14.5 Revenue and Operating Profits

11.15 Tokyo Electron Ltd.

11.15.1 Company Details (HQ, Foundation Year, Employee Strength)

11.15.2 Market Presence, By Segment and Geography

11.15.3 Key Developments

11.15.4 Strategy and Historical Roadmap

11.15.5 Revenue and Operating Profits

11.16 Ultratech Inc.

11.16.1 Company Details (HQ, Foundation Year, Employee Strength)

11.16.2 Market Presence, By Segment and Geography

11.16.3 Key Developments

11.16.4 Strategy and Historical Roadmap

11.16.5 Revenue and Operating Profits

11.17 NCD Co., Ltd.

11.17.1 Company Details (HQ, Foundation Year, Employee Strength)

11.17.2 Market Presence, By Segment and Geography

11.17.3 Key Developments

11.17.4 Strategy and Historical Roadmap

11.17.5 Revenue and Operating Profits

11.18 Lotus Applied Technology

11.18.1 Company Details (HQ, Foundation Year, Employee Strength)

11.18.2 Market Presence, By Segment and Geography

11.18.3 Key Developments

11.18.4 Strategy and Historical Roadmap

11.18.5 Revenue and Operating Profits

List of Tables

TABLE 1 Global Atomic Layer Deposition Equipment Market Snapshot

TABLE 2 North America Atomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 3 North America Atomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 4 North America Atomic Layer Deposition Equipment Market Size and Forecast, by Country, 2015 - 2024 (USD Million)

TABLE 5 Europe Atomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 6 Europe Atomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 7 Europe Atomic Layer Deposition Equipment Market Size and Forecast, by Country, 2015 - 2024 (USD Million)

TABLE 8 Asia PacificAtomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 9 Asia PacificAtomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 10 Asia PacificAtomic Layer Deposition Equipment Market Size and Forecast, by Country, 2015 - 2024 (USD Million)

TABLE 11 Middle East and Africa Atomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 12 Middle East and AfricaAtomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 13 Latin America Atomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 14 Latin AmericaAtomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 15 U.S. Atomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 16 U.S.Atomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 17 Canada Atomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 18 Canada Atomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 19 Rest of North America Atomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 20 Rest of North AmericaAtomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 21 U.K. Atomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 22 U.K.Atomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 23 Germany Atomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 24 Germany Atomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 25 France Atomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 2 France Atomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 26 Italy Atomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 27 Italy Atomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 28 Rest of Europe Atomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 29 Rest of Europe Atomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 30 China Atomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 31 China Atomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 32 Japan Atomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 33 Japan Atomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 34 India Atomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 35 India Atomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 36 Taiwan Atomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 37 Taiwan Atomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 38 South KoreaAtomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 39 South Korea Atomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

TABLE 40 Rest of Asia Pacific Atomic Layer Deposition Equipment Market Size and Forecast, by Type, 2015 - 2024 (USD Million)

TABLE 41 Rest of Asia Pacific Atomic Layer Deposition Equipment Market Size and Forecast, by Application, 2015 - 2024 (USD Million)

List of Figures

FIG. 1 Global Atomic Layer Deposition EquipmentMarket Segmentation, by Type and Application

FIG. 2 Aluminum Oxide (Al2O3 ALD) ALD segment, market size and forecast, 2015-2024 (In USD Million)

FIG. 3 Catalytic ALD segment, market size and forecast, 2015-2024 (In USD Million)

FIG. 4 Metal ALD segment, market size and forecast, 2015-2024 (In USD Million)

FIG. 5 ALD on Polymers segment, market size and forecast, 2015-2024 (In USD Million)

FIG. 6 Others segment, market size and forecast, 2015-2024 (In USD Million)

FIG. 7 Semiconductor & Electronics segment, market size and forecast, 2015-2024 (In USD Million)

FIG. 8 Barrier Layers segment, market size and forecast, 2015-2024 (In USD Million)

FIG. 9 Integrated Circuit (IC) Applicationssegment, market size and forecast, 2015-2024 (In USD Million)

FIG. 10 Solar Panels segment, market size and forecast, 2015-2024 (In USD Million)

FIG. 11 Display Panels segment, market size and forecast, 2015-2024 (In USD Million)

FIG. 12 Sensorssegment, market size and forecast, 2015-2024 (In USD Million)

FIG. 13 Otherssegment, market size and forecast, 2015-2024 (In USD Million)

FIG. 14 Research and Development segment, market size and forecast, 2015-2024 (In USD Million)

FIG. 15 North America Atomic Layer DepositionEquipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 16 EuropeAtomic Layer DepositionEquipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 17 Asia PacificAtomic Layer DepositionEquipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 18 Middle East and AfricaAtomic Layer DepositionEquipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 19 Latin America Atomic Layer DepositionEquipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 20 U.S. Atomic Layer Deposition Equipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 21 Canada Atomic Layer Deposition Equipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 22 Rest of North America Atomic Layer Deposition Equipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 23 U.K. Atomic Layer DepositionEquipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 24 GermanyAtomic Layer Deposition Equipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 25 France Atomic Layer Deposition Equipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 26 ItalyAtomic Layer Deposition Equipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 27 Rest of EuropeAtomic Layer DepositionEquipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 28 China Atomic Layer DepositionEquipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 29 JapanAtomic Layer Deposition Equipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 30 IndiaAtomic Layer DepositionEquipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 31 TaiwanAtomic Layer Deposition Equipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 32 South KoreaAtomic Layer DepositionEquipment Market Revenue, 2015 - 2024 (USD Million)

FIG. 33 Rest of Asia Pacific Atomic Layer DepositionEquipment Market Revenue, 2015 - 2024 (USD Million)